Artificial Intelligence in Finance: Practical Use Cases

Artificial Intelligence in Finance: Practical Use Cases Artificial intelligence has moved beyond theoretical discussion and marketing narratives—it is now actively shaping how financial decisions are supported, risks are monitored, and portfolios are managed. In finance, the value of AI does not lie in replacing human judgment, but in enhancing it. When applied with discipline, artificial intelligence becomes a powerful tool for improving analytical depth, efficiency, and transparency. From Buzzword to Operational Tool For many years, artificial intelligence was discussed primarily as a future promise. Today, it is increasingly embedded within operational workflows across financial services. AI systems can process vast amounts of data, identify patterns, and surface insights that would be difficult to detect through traditional analysis alone. This capability is particularly relevant in environments characterized by complexity, speed, and information overload. AI in Portfolio Analytics One of the most tangible applications of AI in finance lies in portfolio analytics. Advanced algorithms support the analysis of correlations, risk exposure, and scenario behavior across asset classes. By continuously evaluating data streams, AI tools enhance the ability to identify emerging risks and opportunities in a timely manner. This allows portfolio managers and advisors to make more informed decisions while maintaining a structured framework. Risk Management and Monitoring Risk management is a natural area for AI application. Continuous monitoring systems can flag anomalies, stress indicators, or deviations from predefined parameters in real time. Rather than reacting after risks materialize, AI-supported systems help anticipate potential issues and support proactive management. This does not eliminate risk, but it improves awareness and response quality. Transparency and Client Communication Artificial intelligence also contributes to improved transparency. By supporting clearer reporting and data visualization, AI enhances communication between advisors and clients. When clients understand how portfolios behave under different scenarios, trust and alignment are strengthened—particularly during periods of volatility. Human Expertise Remains Central Despite technological progress, financial decision-making cannot be fully automated. Context, experience, and responsibility remain essential. AI is most effective when used as a decision-support tool, complementing professional judgment rather than replacing it. The strongest outcomes emerge when technology and human expertise operate together within a disciplined process. Conclusion Artificial intelligence is reshaping finance not by removing people from the process, but by enabling better-informed decisions. As adoption continues, the focus should remain on practical use cases, transparency, and responsible integration within established investment frameworks. Originally published on LinkedIn: Read the original post on LinkedIn This content is provided for informational purposes only and does not constitute investment advice or a solicitation to the public.

October 11th: Shock and Repricing as Trade Tensions Trigger a Global Market Selloff

October 11th: Shock and Repricing as Trade Tensions Trigger a Global Market Selloff October 11th marked a sudden and violent repricing across global financial markets. Within minutes, risk assets reacted sharply to the announcement of new 100% U.S. tariffs on Chinese goods, reigniting trade-war fears and triggering a broad-based selloff across equities and cryptocurrencies. The scale and speed of the move highlighted how interconnected and fragile global markets remain when faced with abrupt geopolitical and policy shocks. A Rapid Loss of Market Capitalization The immediate reaction was severe: $1.6–$1.7 trillion wiped out from global equity markets Approximately $250 billion erased from the cryptocurrency market This “Black Friday” moment for markets unfolded within minutes, underscoring the sensitivity of investor sentiment to trade-related developments between the world’s two largest economies. Equity Markets Under Pressure U.S. equity indices recorded their steepest single-day declines in months: S&P 500: -2.7%, the sharpest drop since April Nasdaq Composite: -3.5%, driven by heavy selling in technology stocks Major technology companies led the downturn: Nvidia: -3.93% Amazon: -4.48% Tesla: -5.11% European and Asian markets mirrored the selloff, with indices across Switzerland, Italy, and other major markets closing deeply in negative territory. Crypto Markets: High Beta, High Impact Cryptocurrencies, traditionally sensitive to risk-off environments, experienced sharp declines as investors reduced exposure. The rapid contraction of approximately $250 billion in crypto market value reflected the sector’s vulnerability to macro and geopolitical shocks, particularly during periods of heightened uncertainty. Flight to Quality: Precious Metals Hold Firm In contrast to equities and crypto, gold and silver demonstrated resilience, reinforcing their role as defensive assets. Spot Gold: approximately $4,015–$4,018 per ounce Silver: around $50.6 per ounce This behavior is consistent with a classic flight-to-quality dynamic, as investors sought protection amid escalating volatility. FX Markets: Constructive Signals for EUR/USD Foreign exchange markets ended the week on a more constructive note for EUR/USD. Safe-haven flows and tariff-driven headlines created sharp intraday moves in the U.S. dollar, while demand for the euro improved into the Friday close, highlighting the complex interplay between trade policy and currency markets. Implications for Portfolio Strategy The events of October 11th serve as a clear reminder of the importance of portfolio diversification and robust risk management. The escalation of trade tensions between the United States and China introduces significant uncertainty for the fourth quarter and beyond. In such an environment, strategic asset allocation and disciplined exposure management become critical. Rather than attempting to predict headline-driven moves, resilient portfolios are built to absorb shocks while maintaining the flexibility to respond as conditions evolve. Final Considerations Market shocks of this magnitude are rarely isolated events. They often signal broader shifts in risk perception and investor behavior. For investors, the lesson remains consistent: diversification, disciplined risk management, and a clear strategic framework are essential tools for navigating today’s interconnected global economy. Original LinkedIn post: Read the original market update on LinkedIn INCOME CAPITAL MANAGEMENT

September 2025 Results: Resilience and Performance in a Volatile Market Environment

September 2025 Results: Resilience and Performance in a Volatile Market Environment “Wake me up when September ends…” sang Green Day. For many investors, September 2025 was indeed a month they would have preferred to skip. Global financial markets experienced exceptional turbulence, elevated uncertainty, and volatility at historically high levels. Gold continued its strong upward trajectory, while geopolitical and macroeconomic developments kept investor sentiment fragile throughout the month. Despite these challenging conditions, our strategies delivered solid positive performance, confirming that discipline, diversification, and a structured risk-based approach can transform uncertainty into opportunity. Market Context: A Month Defined by Volatility September unfolded against a backdrop of persistent geopolitical tension, macroeconomic realignment, and heightened sensitivity to policy signals. In such an environment, markets often reward resilience rather than speculation. Short-term reactions can amplify volatility, while structured strategies focused on risk control tend to demonstrate greater stability. Forex Fund Performance – Aggressive Level Even in this highly unstable context, the Forex Fund (Aggressive Level) closed the month with positive results: September 2025: +2.30% Year-to-date (January–September 2025): +28.16% Cumulative since inception (April 2024): +58.21% Since the beginning of August 2025, the strategy has been managed with a more cautious and prudent approach, reflecting the exceptionally high volatility observed across markets. This adjustment highlights the importance of flexibility within a disciplined framework, allowing portfolios to adapt while maintaining clear risk controls. Real Estate Fund Performance The Real Estate Fund also continued to deliver steady growth during September: September 2025: +0.45% Year-to-date (January–September 2025): +6.44% Cumulative since inception (April 2024): +12.64% While summer months typically represent a slowdown for the real estate sector, activity traditionally resumes with the arrival of autumn. Growth continues to be supported by sustained demand for tangible assets, particularly from investors seeking stability amid broader market uncertainty. Physical Gold Allocation Gold remained a central component of portfolio protection strategies throughout September. Purchased in September: 1.6 kg Total gold in custody: 11.6 kg Market value as of 30/09/2025: €1,228,440 (€105.90 per gram) The increase in demand is consistent with investors’ continued search for protection, reinforced by the strengthening of the spot gold price. In periods of elevated uncertainty, physical gold continues to fulfill its role as a strategic store of value. Transparency and Reporting Detailed performance reports are available at the following link: Access detailed reports → Active clients can find comprehensive data for all managed financial instruments in the private area, under the RESULTS section. Final Considerations September 2025 reinforces a key lesson: in times of heightened uncertainty, resilient strategies grounded in diversification and risk discipline make the difference. While markets remain unpredictable, structured investment approaches continue to demonstrate their ability not only to withstand volatility, but to convert it into sustainable performance. Original LinkedIn post: Read the original update on LinkedIn INCOME CAPITAL MANAGEMENT

July 2025: Extreme Volatility and Forex Fund Performance Under Unprecedented Market Stress

July 2025: Extreme Volatility and Forex Fund Performance Under Unprecedented Market Stress July 2025 proved to be one of the most challenging months in recent financial market history, particularly during its final two weeks. A period that is typically characterized by low volatility and reduced trading activity instead delivered extreme and unpredictable market movements, driven by a combination of political tension, speculative positioning, and fragile liquidity conditions. An Unusual Market Environment The month was dominated by escalating tensions over trade tariffs between Europe and the United States. These developments triggered a rapid sequence of events that destabilized the currency markets, particularly the EUR/USD pair. Initially, the European Central Bank intervened to artificially support the Euro, aiming to strengthen the European Commission’s position during ongoing negotiations. This was followed by a swift resurgence of the US Dollar as the dominant global currency. Crucially, these movements occurred against a backdrop of very low trading volumes, amplifying price swings and resulting in levels of volatility that, in certain moments, were unprecedented—even compared to the 2008 financial crisis. EUR/USD: Exceptional Price Swings The EUR/USD exchange rate illustrated the severity of market dislocation: Such rapid reversals within a compressed timeframe underscore the fragility of market sentiment and the risks associated with speculative flows during low-liquidity periods. Geopolitical Escalation and Risk Perception Market instability was further compounded by emerging geopolitical tensions, including the deployment of US submarines. While the prospect of nuclear escalation remains theoretical, even the suggestion of such risk materially affects investor behavior, volatility expectations, and capital allocation decisions. In environments like this, risk perception often outweighs fundamentals, creating conditions where price movements become disconnected from traditional valuation frameworks. Forex Fund Performance Overview Against this exceptionally turbulent backdrop, the Forex Fund (Aggressive Strategy) recorded the following results: While July closed negatively, the broader performance context remains solid, reflecting the strength of the strategy over longer horizons. Capital Protection as a Priority In periods of extreme and irregular volatility, prudence becomes essential. Our primary objective remains capital protection, with profit generation as a secondary goal. While speculative market movements are inherently unpredictable and beyond direct control, our focus is on maintaining vigilance and preserving the ability to act decisively when conditions normalize. This disciplined approach allows us to manage drawdowns while keeping portfolios positioned for recovery when market dynamics become more rational. Transparency and Reporting A detailed monthly return overview is available in the private area: View the full July 2025 performance report → We believe transparent reporting is essential, especially during challenging phases, enabling investors to evaluate performance within its proper market context. Final Considerations July 2025 serves as a reminder that extreme volatility can emerge even during periods traditionally considered stable. In such environments, discipline, risk management, and a long-term perspective remain the most effective tools for navigating uncertainty. INCOME CAPITAL MANAGEMENT

Risk Management and Consistency: The Foundations of Sustainable Investment Results

Risk Management and Consistency: The Foundations of Sustainable Investment Results Investment performance is often judged by returns alone. However, over full market cycles, it is risk management—not return maximization—that ultimately determines the sustainability of results. In an environment characterized by frequent volatility, rapid sentiment shifts, and geopolitical uncertainty, the ability to control downside exposure becomes a decisive competitive advantage. Why Risk Management Comes First Every investment strategy operates within uncertainty. The difference between durable performance and capital erosion lies in how risk is identified, measured, and managed. Effective risk management is not reactive. It is embedded into portfolio construction and execution through: Defined exposure limits aligned with volatility Diversification across instruments and risk drivers Continuous monitoring and adjustment of positions This framework allows portfolios to remain operational even when market conditions deteriorate. Consistency Across Market Cycles Short-term results can be influenced by favorable market phases. Consistency, however, is achieved only through disciplined execution across multiple cycles. Strategies that prioritize repeatability over opportunistic risk-taking are better positioned to deliver stable outcomes over time. Capital Preservation as a Strategic Objective Preserving capital during adverse phases is not a defensive stance—it is a strategic choice that enables long-term participation. By limiting drawdowns and avoiding forced decisions, portfolios maintain the flexibility required to reallocate capital when opportunities emerge. Risk Management and Investor Alignment Transparent risk frameworks also strengthen alignment between investors and portfolio managers. When risk parameters are clearly defined and consistently applied, investors can evaluate performance with a full understanding of the trade-offs involved. Final Considerations In uncertain markets, consistency is rarely accidental. It is the outcome of structured processes, disciplined risk controls, and a long-term perspective that prioritizes durability over short-term excitement. Original LinkedIn post: Read the original discussion on LinkedIn INCOME CAPITAL MANAGEMENT

Managing Volatility in Forex Markets: A Disciplined Investment Framework

Managing Volatility in Forex Markets: A Disciplined Investment Framework Volatility has become a structural feature of global financial markets. In 2025, currency markets in particular have reflected a complex mix of monetary policy divergence, geopolitical tension, and shifting capital flows. For investors, this environment reinforces a simple truth: performance is not driven by prediction, but by process. At INCOME CAPITAL MANAGEMENT, our approach to Forex investing is built around this principle. Rather than reacting to short-term noise, we focus on structured execution, controlled exposure, and continuous risk assessment. The Forex Market in 2025: Complexity, Not Chaos Foreign exchange markets are often perceived as purely speculative. In reality, they are among the most liquid and information-rich markets globally. However, in periods of heightened uncertainty, liquidity alone is not enough. Throughout 2025, FX markets have been influenced by: Diverging interest rate expectations across major economies Persistent geopolitical risk affecting capital allocation Increased correlation between currencies and broader risk assets This backdrop rewards strategies that are adaptive, disciplined, and grounded in measurable risk parameters. A Structured Approach to Forex Exposure Our Forex strategy does not rely on directional bets or discretionary timing. Instead, it is designed to operate through a defined framework that emphasizes: Risk-adjusted positioning, with predefined exposure limits Active management based on evolving market conditions Capital preservation as a core objective, not a secondary consideration Consistency of execution, reducing emotional decision-making This structure allows the strategy to remain operational even when market conditions become less predictable. Why Discipline Matters More Than Direction In volatile markets, attempting to forecast every move often leads to overexposure and inconsistent outcomes. A disciplined framework, by contrast, focuses on managing what can be controlled: risk, position sizing, and execution quality. Our experience confirms that sustainable performance in Forex investing is achieved not by maximizing exposure, but by maintaining flexibility while respecting defined risk constraints. Transparency and Investor Alignment Transparency remains a central pillar of our investment philosophy. Clear reporting, measurable performance, and a well-defined strategy allow investors to understand not only what results are achieved, but how they are generated. In an environment where volatility is likely to persist, clarity and structure become competitive advantages. LinkedIn Source This article is based on the original update published on LinkedIn: View the original LinkedIn post → Looking Forward As global markets continue to evolve, our focus remains unchanged: disciplined execution, robust risk management, and consistent alignment with investor objectives. In Forex markets especially, the ability to navigate volatility with structure—not speculation—will continue to define long-term success. INCOME CAPITAL MANAGEMENT

From ESG to AI: Hype Cycle or Structural Shift in Investing?

From ESG to AI: Hype Cycle or Structural Shift in Investing? Financial markets have always been fertile ground for narratives. Over the years, entire investment frameworks have risen, peaked, and faded—often driven as much by storytelling as by substance. Few examples illustrate this better than the recent trajectory of ESG investing. A few years ago, ESG was everywhere. Asset managers, funds, and advisory firms rushed to demonstrate alignment with environmental, social, and governance principles. New products were launched, reporting frameworks multiplied, and ESG quickly became a commercial and marketing standard. Then, almost as quickly, the momentum faded. The Rise and Cooling of ESG Today, much of the ESG hype has dissipated. Many ESG-labelled products have been rebranded, consolidated, or quietly discontinued. Investors have shifted their focus, becoming more selective and increasingly sceptical of surface-level claims that lack measurable impact. This evolution does not mean sustainability has lost relevance. Rather, it highlights a familiar pattern in finance: when a concept becomes primarily a narrative tool instead of an operational discipline, disillusionment follows. AI Takes Centre Stage Now, a new theme dominates the conversation: Artificial Intelligence. From asset managers to analysts and technology providers, AI is being embraced across the investment industry. The enthusiasm is unmistakable. Yet this raises a critical question: is AI simply the next ESG—another hype cycle destined to fade? Where AI Is Already Changing the Game Unlike ESG narratives, AI is already delivering tangible applications—particularly in trading and, even more so, in the foreign exchange market. Machine learning models are increasingly used to: Optimize signal detection across complex market environments Adapt execution strategies dynamically Manage risk exposure in real time Process vast volumes of macroeconomic data, news flow, and central bank communications Some investment strategies now rely on AI-driven systems to interpret market sentiment and anticipate currency movements with a speed and depth that traditional models cannot replicate. Why AI Is Not a Shortcut That said, AI is not magic. Its effectiveness depends on data quality, model governance, and disciplined human oversight. Without these elements, AI risks becoming little more than a sophisticated buzzword—much like ESG did at its peak. Technology alone does not eliminate risk. It reshapes how risk is identified, measured, and managed. The Key Difference Between ESG and AI The crucial distinction lies in utility. While ESG often struggled to move beyond narrative alignment, AI offers concrete tools that directly influence decision-making processes. It enhances speed, consistency, and analytical depth—but only when embedded within a robust investment framework. Still, it is too early to declare AI a definitive structural shift. Finance has a long history of turning innovation into storytelling cycles: enthusiasm, saturation, disillusionment, and eventual correction. A Measured Perspective AI may indeed reshape how investments are managed—but only if applied with discipline, transparency, and accountability. Otherwise, it risks following the same arc as previous trends. In investing, technology should serve process—not replace judgment. Understanding this distinction is what separates durable innovation from temporary hype. This article is based on a recent market commentary originally published on LinkedIn. 👉 Read the original LinkedIn post here Paolo Volpicelli INCOME CAPITAL MANAGEMENT s.r.o.

INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction

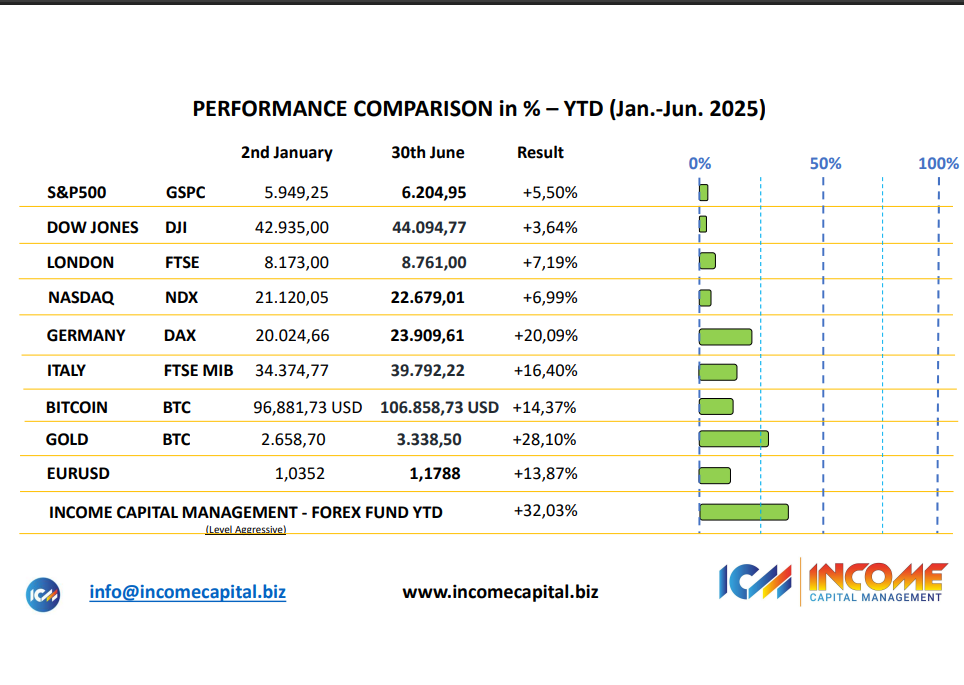

INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction The first half of 2025 has been anything but simple for global financial markets. Persistent geopolitical tensions, fluctuating monetary policies, and ongoing macroeconomic uncertainty have created an environment where consistency and discipline matter more than bold predictions. Against this backdrop, INCOME CAPITAL MANAGEMENT delivered a solid and measurable result, confirming the robustness of its investment framework and the effectiveness of its risk-controlled execution. 📊 Strong Performance in a Challenging Environment During the first half of 2025, our Aggressive Investment Level achieved: +32.03% cumulative return (H1 2025) +62.08% cumulative return since April 2024 These figures are not the result of isolated market events or short-term positioning. They reflect a structured and repeatable investment process built around: Disciplined FX strategy execution Dynamic exposure management Continuous risk monitoring and adjustment Data-driven decision-making Past performance refers to the Aggressive Investment Level and is not indicative of future results. 📌 Structure Over Speculation As highlighted by our Founder & CEO, Paolo Volpicelli, performance is not driven by luck: “Our edge is not luck — it is structure, conviction, and execution.” At INCOME CAPITAL MANAGEMENT, we do not attempt to predict markets. Instead, we focus on understanding them, adapting to changing conditions, and maintaining a disciplined framework that prioritizes capital preservation alongside growth. In an environment where many strategies struggle to remain consistent, our approach continues to demonstrate resilience through methodical positioning and controlled risk exposure. 🔍 Transparency and Measurable Results We believe that performance should always be: Measurable – backed by real data Transparent – clearly reported and accessible Consistent – aligned with a defined investment process Our results reflect not only market opportunities but also the strength of a framework designed to operate effectively during both expansionary and volatile phases. 🔗 Further Insights For the original update and additional context, you can view the LinkedIn article here: View the original LinkedIn post → 🧠 Looking Ahead The first half of 2025 reinforces a key principle: in complex markets, conviction and consistency outperform noise and reaction. As we move into the second half of the year, our focus remains unchanged — protecting capital, managing risk intelligently, and delivering sustainable performance through disciplined execution. INCOME CAPITAL MANAGEMENT continues to build results through structure, not shortcuts.

Navigating Storms, Delivering Solid Results: Our First Half of 2025

Navigating Storms, Delivering Solid Results: Our First Half of 2025 The first half of 2025 has tested investors worldwide. Geopolitical tensions, persistent inflationary pressures, and volatile global markets have created an environment where consistency has been difficult to achieve and true outperformance even harder. Yet it is precisely during these phases that disciplined investment strategies reveal their value. A Market Environment Defined by Complexity The past six months can reasonably be described as a period of global instability. Financial markets have had to absorb overlapping shocks — from geopolitical uncertainty and shifting monetary policies to sudden changes in risk sentiment. In such an environment, remaining invested is not enough. Navigating volatility requires clarity of process, disciplined execution, and the ability to distinguish noise from structural opportunity. Performance That Reflects Method, Not Momentum At Income Capital Management, we do not aim to react to markets — we aim to understand them, structure around them, and outperform them through disciplined strategy. As we close the first half of 2025, the results of this approach are clearly visible: June 2025: +3.45% Q2 2025: +12.00% Year-to-Date (Jan–Jun 2025): +32.03% Cumulative since April 2024: +62.08% These figures refer to the Aggressive Investment Level of our flagship Forex strategy. As always, it is important to note that past performance is not indicative of future results. Why These Results Matter Outperformance in a strong market can be attributed to momentum. Outperformance in a fragile and uncertain market, however, reflects structure, risk control, and execution. Our results are the outcome of: A proprietary FX strategy built on active market analysis Disciplined risk management and exposure control Flexibility in adapting to rapidly changing market conditions Continuous focus on capital protection alongside return generation While many investors struggled to remain invested amid volatility, our strategy maintained coherence and direction. Conviction Over Noise Periods dominated by political headlines, central bank speculation, and short-term market reactions often tempt investors to abandon strategy in favor of emotion. We believe the opposite approach is required. In complex environments, capital seeks conviction, consistency, and process — not narratives. This philosophy has guided our decisions throughout the first half of 2025 and continues to shape our outlook for the months ahead. A Message to Investors To our investors, we extend our sincere appreciation for your continued trust. Your confidence allows us to execute strategies with discipline and long-term perspective. For those observing from the sidelines, this period serves as a reminder that sustainable performance is built through method, not speculation. A performance comparison chart related to this update is available on LinkedIn at the following link: View the performance update on LinkedIn As markets continue to evolve, our commitment remains unchanged: protecting capital, managing risk, and delivering consistent, transparent results.

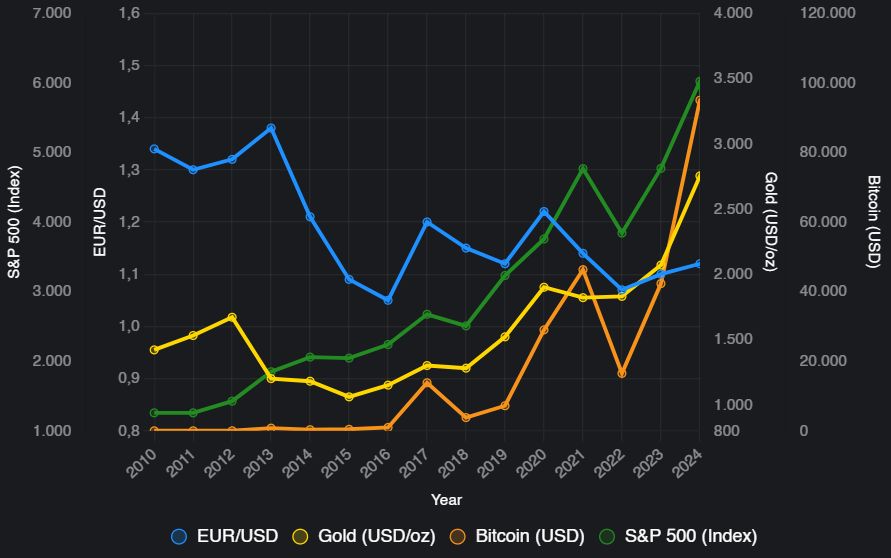

Global Geopolitical and Economic Outlook 2025: A World in Turmoil

Global Geopolitical and Economic Outlook 2025: A World in Turmoil The global landscape in 2025 is marked by elevated geopolitical tension and economic fragmentation. With the number of active armed conflicts reaching levels unseen since the Second World War, markets are navigating an environment defined by uncertainty, volatility, and structural change. According to current estimates, the world is facing 56 active armed conflicts, a record high that continues to influence economic stability, capital flows, and investor sentiment. Geopolitical Flashpoints Shaping Markets Several regional conflicts and geopolitical developments are playing a decisive role in reshaping global markets: Israel–Iran Escalation: Israel’s recent airstrikes on Iranian nuclear and military facilities, followed by Iran’s retaliatory ballistic missile launches, have intensified fears of a broader Middle East conflict. Ukraine War: Continued Russian advances and Ukrainian counterstrikes, including attacks on the Crimean Bridge, are sustaining pressure on energy and food prices, contributing to global inflationary risks. China–Taiwan Tensions: China’s military drills around Taiwan — a critical semiconductor hub — are disrupting supply chains and increasing uncertainty across global manufacturing sectors. India–Pakistan Relations: Rising border tensions and diplomatic frictions, particularly around Kashmir, have escalated during 2025, adding further instability to the region. Trade Policy Shifts: President Trump’s renewed focus on aggressive tariff policies has reignited trade tensions, disrupting supply chains and increasing input costs globally. Economic Impacts Across Asset Classes The economic consequences of these geopolitical dynamics are already visible across currencies, commodities, and financial markets. Currencies: The Euro has strengthened against the US Dollar in recent sessions, with EUR/USD trading near 1.15, driven by easing US inflation and expectations of Federal Reserve rate cuts. Commodities: Gold surged to a record high of approximately $3,427 per ounce, reflecting strong demand for safe-haven assets amid escalating geopolitical risks. Oil: Brent crude prices increased by 6–14% following Middle East escalations, with further upside risks linked to potential disruptions in the Strait of Hormuz. Cryptocurrencies: Bitcoin briefly surpassed $110,000 before retracing to around $105,000, reflecting heightened risk sensitivity and geopolitical uncertainty. Equity Markets: The S&P 500 declined approximately 1.13%, falling to around 5,977, while Nasdaq and Dow Jones also recorded losses amid global risk-off sentiment. Structural Global Trends Beyond immediate market reactions, several long-term structural trends are emerging: Militarization: Global defense spending has reached approximately $2.4 trillion, underscoring the persistent shift toward security-driven fiscal priorities. Economic Fragmentation: Intensifying US–China–Russia rivalries and the expansion of BRICS-led initiatives are accelerating deglobalization, with estimates suggesting a potential 3% reduction in global trade. Inflation Risks: Elevated energy prices and renewed tariffs are complicating central banks’ efforts to ease monetary policy, delaying potential rate cuts. Implications for Investors In this environment, traditional assumptions about market stability are being challenged. Investors are increasingly prioritizing: Exposure to safe-haven assets such as gold and selected currencies Diversification across asset classes and geographies Active risk management to mitigate geopolitical shocks Businesses and investors alike must adapt to a world where resilience, flexibility, and strategic allocation are essential for navigating uncertainty. Final Considerations The combination of geopolitical conflict, economic fragmentation, and volatile markets defines the investment landscape of 2025. In such a context, long-term success depends less on short-term reactions and more on structured decision-making, disciplined risk management, and a clear understanding of global dynamics. Original LinkedIn analysis: Read the full discussion on LinkedIn