Confidence, Emerging Markets and Debt Investment: Navigating Opportunity Through Structure

Confidence, Emerging Markets and Debt Investment: Navigating Opportunity Through Structure In a global financial environment shaped by uncertainty, confidence is not a sentiment — it is the result of structure, discipline, and informed decision-making. Emerging markets continue to attract investor attention, not because they are simple, but because they offer opportunities that are often uncorrelated with traditional developed markets. Within this context, debt investments play a strategic role, combining yield potential with structured risk management when approached correctly. Why Confidence Matters in Emerging Markets Emerging markets are frequently associated with volatility, political risk, and uneven growth cycles. While these factors are real, they also create inefficiencies — and inefficiencies are precisely where disciplined investors can find value. Confidence in this space does not come from speculation. It comes from: Careful jurisdiction and counterparty selection Clear legal and regulatory frameworks Defined risk parameters and exit strategies Continuous monitoring of macroeconomic and geopolitical dynamics When these elements are in place, emerging market exposure becomes a calculated allocation rather than a leap of faith. The Strategic Role of Debt Investment Debt investment represents a different approach compared to pure equity exposure. Instead of relying solely on growth narratives, debt strategies focus on contractual cash flows, capital structure positioning, and downside protection. In emerging markets, this approach can be particularly effective. Well-structured debt instruments may offer: Predictable income streams Priority positioning in the capital structure Lower volatility compared to equity investments Improved portfolio diversification The key lies in rigorous due diligence and conservative structuring — elements that transform complexity into opportunity. From Perceived Risk to Managed Exposure Risk in emerging markets is often misunderstood. The real risk is not volatility itself, but the absence of controls, transparency, and governance. By focusing on structured debt solutions, investors can access emerging market opportunities while maintaining alignment with capital preservation objectives. This approach shifts the narrative from speculative exposure to intentional allocation. Confidence as a Competitive Advantage In periods where global markets oscillate between optimism and fear, confidence becomes a differentiating factor. Not blind confidence, but informed confidence — built on data, structure, and experience. At INCOME CAPITAL MANAGEMENT, confidence is the outcome of method. Our investment philosophy emphasizes clarity over complexity and structure over narratives, particularly when operating in less conventional markets. A Measured Path Forward Emerging markets and debt investments are not designed for short-term speculation. They are components of a broader strategy aimed at diversification, income generation, and long-term resilience. By combining disciplined risk management with selective exposure, it is possible to navigate complexity without compromising on control. INCOME CAPITAL MANAGEMENT s.r.o. 🔗 Related LinkedIn post: Confidence, Emerging Markets and Debt Investment

Managing Volatility in Forex Markets: A Disciplined Investment Framework

Managing Volatility in Forex Markets: A Disciplined Investment Framework Volatility has become a structural feature of global financial markets. In 2025, currency markets in particular have reflected a complex mix of monetary policy divergence, geopolitical tension, and shifting capital flows. For investors, this environment reinforces a simple truth: performance is not driven by prediction, but by process. At INCOME CAPITAL MANAGEMENT, our approach to Forex investing is built around this principle. Rather than reacting to short-term noise, we focus on structured execution, controlled exposure, and continuous risk assessment. The Forex Market in 2025: Complexity, Not Chaos Foreign exchange markets are often perceived as purely speculative. In reality, they are among the most liquid and information-rich markets globally. However, in periods of heightened uncertainty, liquidity alone is not enough. Throughout 2025, FX markets have been influenced by: Diverging interest rate expectations across major economies Persistent geopolitical risk affecting capital allocation Increased correlation between currencies and broader risk assets This backdrop rewards strategies that are adaptive, disciplined, and grounded in measurable risk parameters. A Structured Approach to Forex Exposure Our Forex strategy does not rely on directional bets or discretionary timing. Instead, it is designed to operate through a defined framework that emphasizes: Risk-adjusted positioning, with predefined exposure limits Active management based on evolving market conditions Capital preservation as a core objective, not a secondary consideration Consistency of execution, reducing emotional decision-making This structure allows the strategy to remain operational even when market conditions become less predictable. Why Discipline Matters More Than Direction In volatile markets, attempting to forecast every move often leads to overexposure and inconsistent outcomes. A disciplined framework, by contrast, focuses on managing what can be controlled: risk, position sizing, and execution quality. Our experience confirms that sustainable performance in Forex investing is achieved not by maximizing exposure, but by maintaining flexibility while respecting defined risk constraints. Transparency and Investor Alignment Transparency remains a central pillar of our investment philosophy. Clear reporting, measurable performance, and a well-defined strategy allow investors to understand not only what results are achieved, but how they are generated. In an environment where volatility is likely to persist, clarity and structure become competitive advantages. LinkedIn Source This article is based on the original update published on LinkedIn: View the original LinkedIn post → Looking Forward As global markets continue to evolve, our focus remains unchanged: disciplined execution, robust risk management, and consistent alignment with investor objectives. In Forex markets especially, the ability to navigate volatility with structure—not speculation—will continue to define long-term success. INCOME CAPITAL MANAGEMENT

INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction

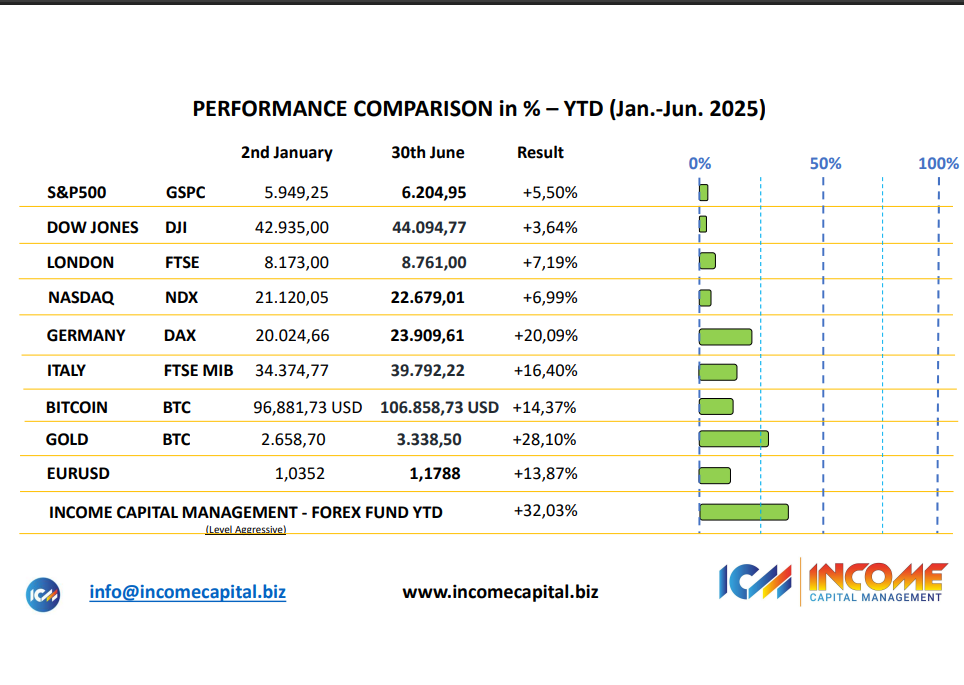

INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction The first half of 2025 has been anything but simple for global financial markets. Persistent geopolitical tensions, fluctuating monetary policies, and ongoing macroeconomic uncertainty have created an environment where consistency and discipline matter more than bold predictions. Against this backdrop, INCOME CAPITAL MANAGEMENT delivered a solid and measurable result, confirming the robustness of its investment framework and the effectiveness of its risk-controlled execution. 📊 Strong Performance in a Challenging Environment During the first half of 2025, our Aggressive Investment Level achieved: +32.03% cumulative return (H1 2025) +62.08% cumulative return since April 2024 These figures are not the result of isolated market events or short-term positioning. They reflect a structured and repeatable investment process built around: Disciplined FX strategy execution Dynamic exposure management Continuous risk monitoring and adjustment Data-driven decision-making Past performance refers to the Aggressive Investment Level and is not indicative of future results. 📌 Structure Over Speculation As highlighted by our Founder & CEO, Paolo Volpicelli, performance is not driven by luck: “Our edge is not luck — it is structure, conviction, and execution.” At INCOME CAPITAL MANAGEMENT, we do not attempt to predict markets. Instead, we focus on understanding them, adapting to changing conditions, and maintaining a disciplined framework that prioritizes capital preservation alongside growth. In an environment where many strategies struggle to remain consistent, our approach continues to demonstrate resilience through methodical positioning and controlled risk exposure. 🔍 Transparency and Measurable Results We believe that performance should always be: Measurable – backed by real data Transparent – clearly reported and accessible Consistent – aligned with a defined investment process Our results reflect not only market opportunities but also the strength of a framework designed to operate effectively during both expansionary and volatile phases. 🔗 Further Insights For the original update and additional context, you can view the LinkedIn article here: View the original LinkedIn post → 🧠 Looking Ahead The first half of 2025 reinforces a key principle: in complex markets, conviction and consistency outperform noise and reaction. As we move into the second half of the year, our focus remains unchanged — protecting capital, managing risk intelligently, and delivering sustainable performance through disciplined execution. INCOME CAPITAL MANAGEMENT continues to build results through structure, not shortcuts.

Navigating Storms, Delivering Solid Results: Our First Half of 2025

Navigating Storms, Delivering Solid Results: Our First Half of 2025 The first half of 2025 has tested investors worldwide. Geopolitical tensions, persistent inflationary pressures, and volatile global markets have created an environment where consistency has been difficult to achieve and true outperformance even harder. Yet it is precisely during these phases that disciplined investment strategies reveal their value. A Market Environment Defined by Complexity The past six months can reasonably be described as a period of global instability. Financial markets have had to absorb overlapping shocks — from geopolitical uncertainty and shifting monetary policies to sudden changes in risk sentiment. In such an environment, remaining invested is not enough. Navigating volatility requires clarity of process, disciplined execution, and the ability to distinguish noise from structural opportunity. Performance That Reflects Method, Not Momentum At Income Capital Management, we do not aim to react to markets — we aim to understand them, structure around them, and outperform them through disciplined strategy. As we close the first half of 2025, the results of this approach are clearly visible: June 2025: +3.45% Q2 2025: +12.00% Year-to-Date (Jan–Jun 2025): +32.03% Cumulative since April 2024: +62.08% These figures refer to the Aggressive Investment Level of our flagship Forex strategy. As always, it is important to note that past performance is not indicative of future results. Why These Results Matter Outperformance in a strong market can be attributed to momentum. Outperformance in a fragile and uncertain market, however, reflects structure, risk control, and execution. Our results are the outcome of: A proprietary FX strategy built on active market analysis Disciplined risk management and exposure control Flexibility in adapting to rapidly changing market conditions Continuous focus on capital protection alongside return generation While many investors struggled to remain invested amid volatility, our strategy maintained coherence and direction. Conviction Over Noise Periods dominated by political headlines, central bank speculation, and short-term market reactions often tempt investors to abandon strategy in favor of emotion. We believe the opposite approach is required. In complex environments, capital seeks conviction, consistency, and process — not narratives. This philosophy has guided our decisions throughout the first half of 2025 and continues to shape our outlook for the months ahead. A Message to Investors To our investors, we extend our sincere appreciation for your continued trust. Your confidence allows us to execute strategies with discipline and long-term perspective. For those observing from the sidelines, this period serves as a reminder that sustainable performance is built through method, not speculation. A performance comparison chart related to this update is available on LinkedIn at the following link: View the performance update on LinkedIn As markets continue to evolve, our commitment remains unchanged: protecting capital, managing risk, and delivering consistent, transparent results.

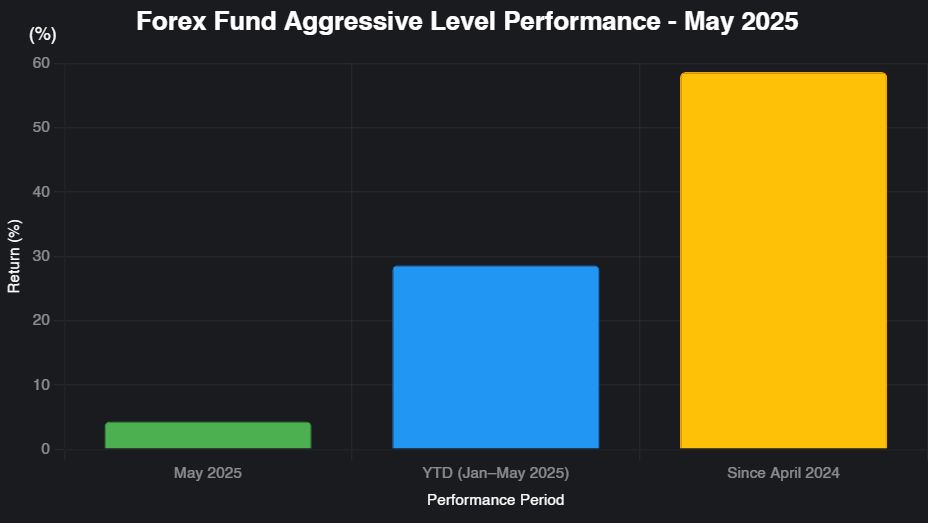

May 2025 Performance Update: Forex Fund (Aggressive Strategy)

May 2025 Performance Update: Forex Fund (Aggressive Strategy) Consistency, discipline, and risk awareness remain central to our investment approach. The performance recorded by the Forex Fund during May 2025 confirms the effectiveness of a structured strategy even in complex and evolving market conditions. Throughout the month, INCOME CAPITAL MANAGEMENT continued to deliver solid and measurable results, supported by active management and deep market expertise. Key Performance Figures May 2025: +4.30% Year-to-Date (January–May 2025): +28.58% Since April 2024 (14 months): +58.63% These figures reflect a period of sustained performance, achieved through a disciplined exposure framework and continuous monitoring of market dynamics. Understanding the Results The Aggressive Level delivered a +4.30% monthly return in May 2025, reinforcing a strong +28.58% YTD performance. This outcome was driven by a combination of selective positioning, adaptive exposure management, and ongoing risk control. Rather than relying on directional bets alone, the strategy focuses on identifying high-probability setups while maintaining a robust risk framework — a balance essential in the foreign exchange market. Longer-Term Perspective Looking beyond the single month, the performance since April 2024 stands at +58.63%. This result highlights the capacity of the strategy to generate value over time, even as volatility and macro uncertainty persist. Higher return potential naturally implies higher risk exposure. For this reason, disciplined execution and continuous oversight remain fundamental elements of the investment process. What This Means for Investors For investors seeking dynamic exposure to the FX market, these results demonstrate how an actively managed approach can deliver consistent outcomes without sacrificing transparency. Performance is monitored, measured, and communicated clearly — ensuring that results are not only achieved, but also understood. Real data. Measurable outcomes. No empty promises. Original LinkedIn post: View on LinkedIn

Forex in the GCC: Insights from the 2025 Dubai Forex Summit

Forex in the GCC: Insights from the 2025 Dubai Forex Summit The Gulf Cooperation Council (GCC) region is rapidly emerging as one of the most dynamic hubs for Forex and alternative investments. The 2025 Dubai Forex Traders Summit offered a clear confirmation of this trend, bringing together traders, brokers, asset managers, fintech companies, and institutional players from across the Middle East and beyond. Over two intense days of panels, exhibitions, and professional discussions, one message stood out clearly: interest in Forex in the GCC is no longer limited to speculative trading platforms. The region is increasingly focused on regulated structures, professional investment solutions, and transparent portfolio strategies. A Maturing Forex Market in the Middle East The enthusiasm surrounding Forex in the GCC reflects a broader evolution of regional capital markets. Investors are seeking structured approaches that combine access to global currency markets with disciplined risk management, regulatory oversight, and institutional-grade governance. This shift marks an important transition: from individual trading toward professionally managed Forex investment strategies designed to fit within diversified portfolios. Income Capital Management’s Positioning Within this evolving landscape, INCOME CAPITAL MANAGEMENT plays a distinctive role. We are proud to be the first — and currently the only — EU-registered investment fund fully dedicated to Forex strategies, operating within a regulated framework that prioritizes transparency, risk control, and investor protection. Our approach is built on: Regulated fund structures compliant with European standards Clear separation between execution, risk management, and oversight A disciplined investment process focused on capital preservation as well as performance This model responds directly to the growing demand in the GCC for solutions that go beyond individual trading accounts, offering instead structured access to Forex markets through a professional investment vehicle. Strategic Dialogue and Future Collaboration The Dubai Summit also provided an opportunity for in-depth discussions with market participants across the region. Several meetings initiated during the event have already laid the groundwork for potential future collaborations, reflecting the strong alignment between regional demand and our investment philosophy. The conversations confirmed that investors in the GCC are increasingly attentive to regulation, governance, and long-term strategy — values that remain central to our operating model. Looking Ahead The momentum observed in Dubai reinforces a broader conviction: Forex, when approached through a regulated and disciplined structure, can represent a meaningful component of modern alternative investment portfolios. As Middle Eastern markets continue to evolve, we remain committed to building bridges between European regulatory standards and the growing sophistication of GCC investors. Original LinkedIn post: View on LinkedIn