October 11th: Shock and Repricing as Trade Tensions Trigger a Global Market Selloff

October 11th marked a sudden and violent repricing across global financial markets.

Within minutes, risk assets reacted sharply to the announcement of new 100% U.S. tariffs on Chinese goods, reigniting trade-war fears and triggering a broad-based selloff across equities and cryptocurrencies.

The scale and speed of the move highlighted how interconnected and fragile global markets remain when faced with abrupt geopolitical and policy shocks.

A Rapid Loss of Market Capitalization

The immediate reaction was severe:

- $1.6–$1.7 trillion wiped out from global equity markets

- Approximately $250 billion erased from the cryptocurrency market

This “Black Friday” moment for markets unfolded within minutes, underscoring the sensitivity of investor sentiment to trade-related developments between the world’s two largest economies.

Equity Markets Under Pressure

U.S. equity indices recorded their steepest single-day declines in months:

- S&P 500: -2.7%, the sharpest drop since April

- Nasdaq Composite: -3.5%, driven by heavy selling in technology stocks

Major technology companies led the downturn:

- Nvidia: -3.93%

- Amazon: -4.48%

- Tesla: -5.11%

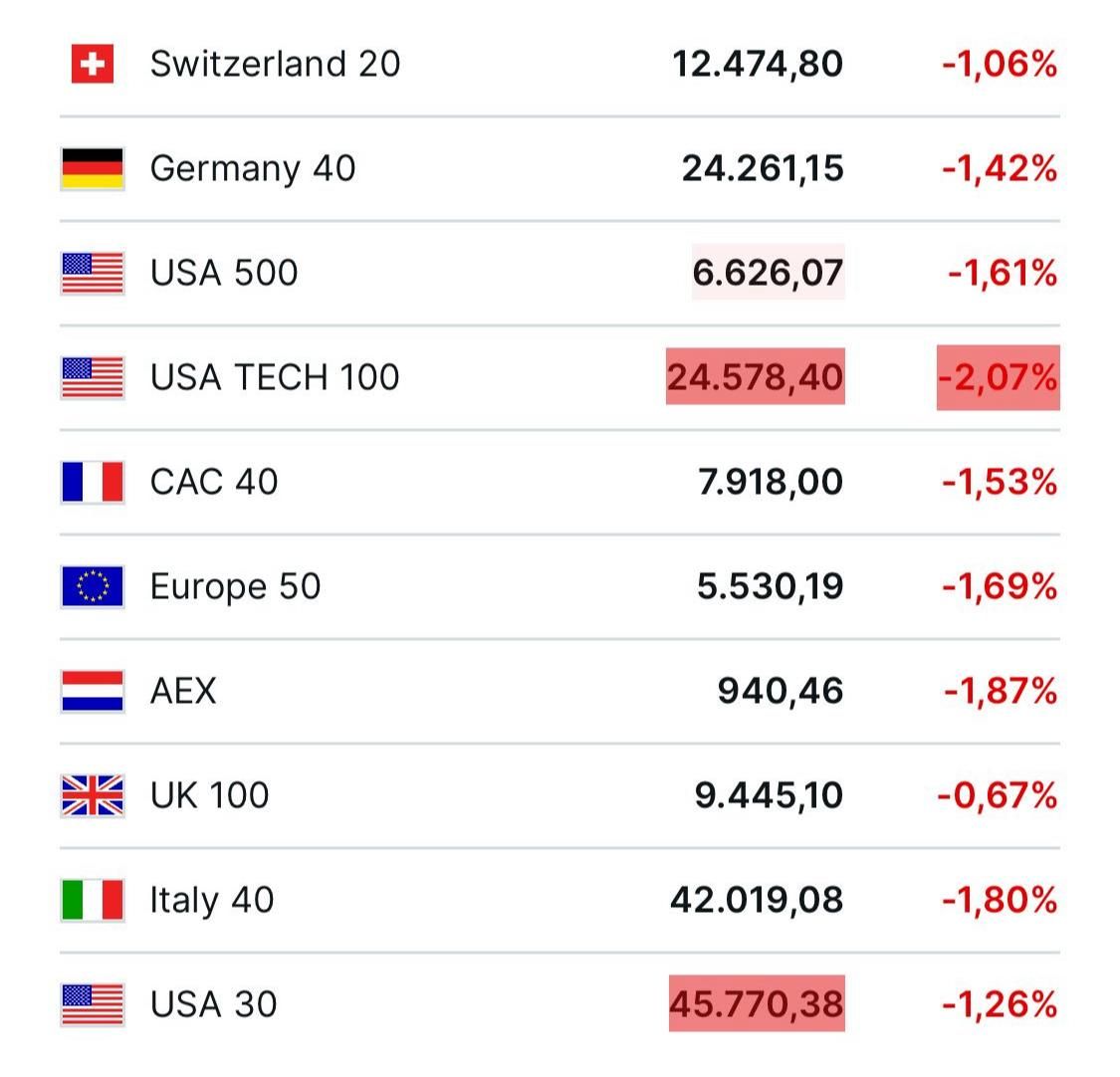

European and Asian markets mirrored the selloff, with indices across Switzerland, Italy, and other major markets closing deeply in negative territory.

Crypto Markets: High Beta, High Impact

Cryptocurrencies, traditionally sensitive to risk-off environments, experienced sharp declines as investors reduced exposure.

The rapid contraction of approximately $250 billion in crypto market value reflected the sector’s vulnerability to macro and geopolitical shocks, particularly during periods of heightened uncertainty.

Flight to Quality: Precious Metals Hold Firm

In contrast to equities and crypto, gold and silver demonstrated resilience, reinforcing their role as defensive assets.

- Spot Gold: approximately $4,015–$4,018 per ounce

- Silver: around $50.6 per ounce

This behavior is consistent with a classic flight-to-quality dynamic, as investors sought protection amid escalating volatility.

FX Markets: Constructive Signals for EUR/USD

Foreign exchange markets ended the week on a more constructive note for EUR/USD.

Safe-haven flows and tariff-driven headlines created sharp intraday moves in the U.S. dollar, while demand for the euro improved into the Friday close, highlighting the complex interplay between trade policy and currency markets.

Implications for Portfolio Strategy

The events of October 11th serve as a clear reminder of the importance of portfolio diversification and robust risk management.

The escalation of trade tensions between the United States and China introduces significant uncertainty for the fourth quarter and beyond. In such an environment, strategic asset allocation and disciplined exposure management become critical.

Rather than attempting to predict headline-driven moves, resilient portfolios are built to absorb shocks while maintaining the flexibility to respond as conditions evolve.

Final Considerations

Market shocks of this magnitude are rarely isolated events. They often signal broader shifts in risk perception and investor behavior.

For investors, the lesson remains consistent: diversification, disciplined risk management, and a clear strategic framework are essential tools for navigating today’s interconnected global economy.

Original LinkedIn post:

Read the original market update on LinkedIn

INCOME CAPITAL MANAGEMENT