PRESS RELEASE – TEARLY RESULTS 2025

Income Capital Management Reports Strong 2025 Performance in a Year of Divergent Global Markets FOR IMMEDIATE RELEASE Date: January 27, 2026 Prague, Czech Republic — Income Capital Management closed 2025 with solid results across its diversified investment strategies, successfully navigating a year marked by sharp divergences between asset classes. The firm enters 2026 with a disciplined, multi-asset approach focused on delivering consistent value to its investors. Market Environment Global markets in 2025 were characterized by pronounced dispersion. Gold emerged as the top-performing major asset class, posting gains of +65.87% and reinforcing its role as a safe-haven asset. Major equity indices, including DAX, NASDAQ, FTSE 100, Euro Stoxx 50, S&P 500, and Dow Jones, recorded positive performances, while Bitcoin declined by -6.35%, reflecting increased volatility and speculative risk. Italy’s FTSE MIB underperformed relative to broader international benchmarks. Key Strategy Performance Income Capital Management’s Forex strategy delivered a standout performance, achieving an annual return of +34.98%. Active currency trading combined with strict risk management allowed the strategy to outperform major traditional benchmarks. The firm’s Real Estate strategy generated stable income-driven returns of +7.71%, supported by premium property assets and consistent cash flow, outperforming several weaker regional equity markets. Additional allocations to global growth and high-yield strategies contributed to overall portfolio diversification and balance. Management Commentary “2025 confirmed that active and diversified strategies are essential in fragmented market conditions,” said Paolo Volpicelli, CEO of Income Capital Management. “Our Forex strategy’s 34.98% return demonstrates how disciplined execution and controlled risk can translate into meaningful performance for our investors.” Nicola Pinchi, CTO of Income Capital Management, added: “By combining high-conviction Forex strategies with stable real estate income and physical gold exposure, we have built portfolios designed to perform across different market cycles rather than simply follow short-term trends.” Strategic Positioning for 2026 Income Capital Management’s multi-asset framework — encompassing Forex for growth, real estate for income, global growth and high-yield strategies for diversification, and physical gold for capital protection — is designed to provide resilience and flexibility in an evolving macroeconomic environment. As the firm enters 2026, this structure aims to balance opportunity and risk, supporting long-term portfolio stability in periods of heightened volatility. About Income Capital Management Income Capital Management is an independent asset management firm specializing in diversified investment solutions across Forex, real estate, global growth, high-yield strategies, and physical asset exposure. The firm focuses on active management, disciplined risk control, and long-term capital preservation and growth. For more information, please visit www.incomecapital.biz or contact the Income Capital Management team directly. LinkedIn press release: https://www.linkedin.com/posts/paolovolpicelli_press-release-tearly-results-2025-activity-7421816797093494784-NoVd

INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction

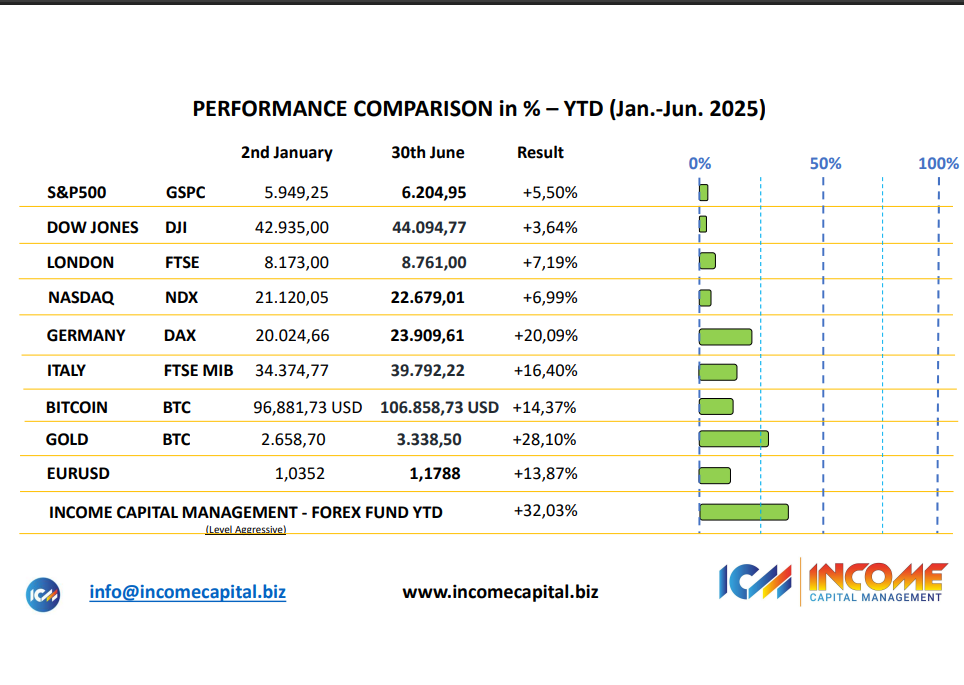

INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction The first half of 2025 has been anything but simple for global financial markets. Persistent geopolitical tensions, fluctuating monetary policies, and ongoing macroeconomic uncertainty have created an environment where consistency and discipline matter more than bold predictions. Against this backdrop, INCOME CAPITAL MANAGEMENT delivered a solid and measurable result, confirming the robustness of its investment framework and the effectiveness of its risk-controlled execution. 📊 Strong Performance in a Challenging Environment During the first half of 2025, our Aggressive Investment Level achieved: +32.03% cumulative return (H1 2025) +62.08% cumulative return since April 2024 These figures are not the result of isolated market events or short-term positioning. They reflect a structured and repeatable investment process built around: Disciplined FX strategy execution Dynamic exposure management Continuous risk monitoring and adjustment Data-driven decision-making Past performance refers to the Aggressive Investment Level and is not indicative of future results. 📌 Structure Over Speculation As highlighted by our Founder & CEO, Paolo Volpicelli, performance is not driven by luck: “Our edge is not luck — it is structure, conviction, and execution.” At INCOME CAPITAL MANAGEMENT, we do not attempt to predict markets. Instead, we focus on understanding them, adapting to changing conditions, and maintaining a disciplined framework that prioritizes capital preservation alongside growth. In an environment where many strategies struggle to remain consistent, our approach continues to demonstrate resilience through methodical positioning and controlled risk exposure. 🔍 Transparency and Measurable Results We believe that performance should always be: Measurable – backed by real data Transparent – clearly reported and accessible Consistent – aligned with a defined investment process Our results reflect not only market opportunities but also the strength of a framework designed to operate effectively during both expansionary and volatile phases. 🔗 Further Insights For the original update and additional context, you can view the LinkedIn article here: View the original LinkedIn post → 🧠 Looking Ahead The first half of 2025 reinforces a key principle: in complex markets, conviction and consistency outperform noise and reaction. As we move into the second half of the year, our focus remains unchanged — protecting capital, managing risk intelligently, and delivering sustainable performance through disciplined execution. INCOME CAPITAL MANAGEMENT continues to build results through structure, not shortcuts.

Navigating Storms, Delivering Solid Results: Our First Half of 2025

Navigating Storms, Delivering Solid Results: Our First Half of 2025 The first half of 2025 has tested investors worldwide. Geopolitical tensions, persistent inflationary pressures, and volatile global markets have created an environment where consistency has been difficult to achieve and true outperformance even harder. Yet it is precisely during these phases that disciplined investment strategies reveal their value. A Market Environment Defined by Complexity The past six months can reasonably be described as a period of global instability. Financial markets have had to absorb overlapping shocks — from geopolitical uncertainty and shifting monetary policies to sudden changes in risk sentiment. In such an environment, remaining invested is not enough. Navigating volatility requires clarity of process, disciplined execution, and the ability to distinguish noise from structural opportunity. Performance That Reflects Method, Not Momentum At Income Capital Management, we do not aim to react to markets — we aim to understand them, structure around them, and outperform them through disciplined strategy. As we close the first half of 2025, the results of this approach are clearly visible: June 2025: +3.45% Q2 2025: +12.00% Year-to-Date (Jan–Jun 2025): +32.03% Cumulative since April 2024: +62.08% These figures refer to the Aggressive Investment Level of our flagship Forex strategy. As always, it is important to note that past performance is not indicative of future results. Why These Results Matter Outperformance in a strong market can be attributed to momentum. Outperformance in a fragile and uncertain market, however, reflects structure, risk control, and execution. Our results are the outcome of: A proprietary FX strategy built on active market analysis Disciplined risk management and exposure control Flexibility in adapting to rapidly changing market conditions Continuous focus on capital protection alongside return generation While many investors struggled to remain invested amid volatility, our strategy maintained coherence and direction. Conviction Over Noise Periods dominated by political headlines, central bank speculation, and short-term market reactions often tempt investors to abandon strategy in favor of emotion. We believe the opposite approach is required. In complex environments, capital seeks conviction, consistency, and process — not narratives. This philosophy has guided our decisions throughout the first half of 2025 and continues to shape our outlook for the months ahead. A Message to Investors To our investors, we extend our sincere appreciation for your continued trust. Your confidence allows us to execute strategies with discipline and long-term perspective. For those observing from the sidelines, this period serves as a reminder that sustainable performance is built through method, not speculation. A performance comparison chart related to this update is available on LinkedIn at the following link: View the performance update on LinkedIn As markets continue to evolve, our commitment remains unchanged: protecting capital, managing risk, and delivering consistent, transparent results.