July 2025: Extreme Volatility and Forex Fund Performance Under Unprecedented Market Stress

July 2025: Extreme Volatility and Forex Fund Performance Under Unprecedented Market Stress July 2025 proved to be one of the most challenging months in recent financial market history, particularly during its final two weeks. A period that is typically characterized by low volatility and reduced trading activity instead delivered extreme and unpredictable market movements, driven by a combination of political tension, speculative positioning, and fragile liquidity conditions. An Unusual Market Environment The month was dominated by escalating tensions over trade tariffs between Europe and the United States. These developments triggered a rapid sequence of events that destabilized the currency markets, particularly the EUR/USD pair. Initially, the European Central Bank intervened to artificially support the Euro, aiming to strengthen the European Commission’s position during ongoing negotiations. This was followed by a swift resurgence of the US Dollar as the dominant global currency. Crucially, these movements occurred against a backdrop of very low trading volumes, amplifying price swings and resulting in levels of volatility that, in certain moments, were unprecedented—even compared to the 2008 financial crisis. EUR/USD: Exceptional Price Swings The EUR/USD exchange rate illustrated the severity of market dislocation: Such rapid reversals within a compressed timeframe underscore the fragility of market sentiment and the risks associated with speculative flows during low-liquidity periods. Geopolitical Escalation and Risk Perception Market instability was further compounded by emerging geopolitical tensions, including the deployment of US submarines. While the prospect of nuclear escalation remains theoretical, even the suggestion of such risk materially affects investor behavior, volatility expectations, and capital allocation decisions. In environments like this, risk perception often outweighs fundamentals, creating conditions where price movements become disconnected from traditional valuation frameworks. Forex Fund Performance Overview Against this exceptionally turbulent backdrop, the Forex Fund (Aggressive Strategy) recorded the following results: While July closed negatively, the broader performance context remains solid, reflecting the strength of the strategy over longer horizons. Capital Protection as a Priority In periods of extreme and irregular volatility, prudence becomes essential. Our primary objective remains capital protection, with profit generation as a secondary goal. While speculative market movements are inherently unpredictable and beyond direct control, our focus is on maintaining vigilance and preserving the ability to act decisively when conditions normalize. This disciplined approach allows us to manage drawdowns while keeping portfolios positioned for recovery when market dynamics become more rational. Transparency and Reporting A detailed monthly return overview is available in the private area: View the full July 2025 performance report → We believe transparent reporting is essential, especially during challenging phases, enabling investors to evaluate performance within its proper market context. Final Considerations July 2025 serves as a reminder that extreme volatility can emerge even during periods traditionally considered stable. In such environments, discipline, risk management, and a long-term perspective remain the most effective tools for navigating uncertainty. INCOME CAPITAL MANAGEMENT

Global Geopolitical and Economic Outlook 2025: A World in Turmoil

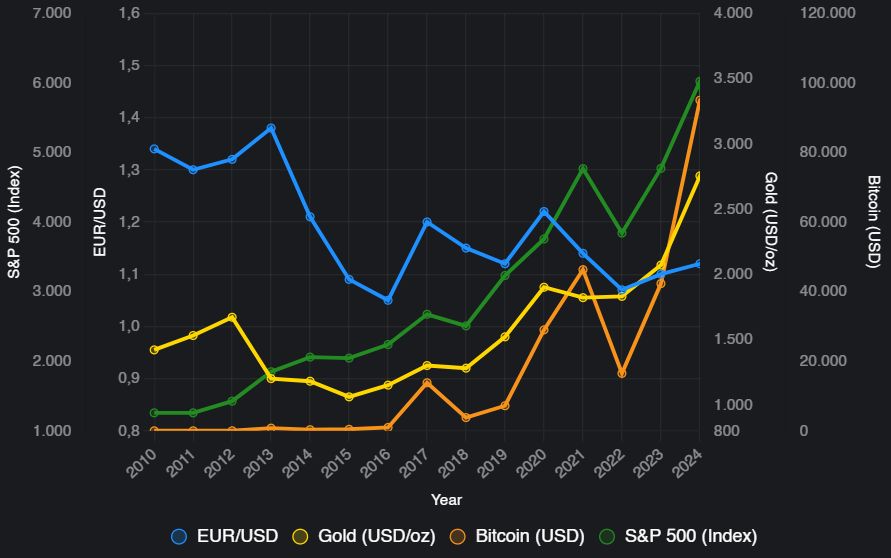

Global Geopolitical and Economic Outlook 2025: A World in Turmoil The global landscape in 2025 is marked by elevated geopolitical tension and economic fragmentation. With the number of active armed conflicts reaching levels unseen since the Second World War, markets are navigating an environment defined by uncertainty, volatility, and structural change. According to current estimates, the world is facing 56 active armed conflicts, a record high that continues to influence economic stability, capital flows, and investor sentiment. Geopolitical Flashpoints Shaping Markets Several regional conflicts and geopolitical developments are playing a decisive role in reshaping global markets: Israel–Iran Escalation: Israel’s recent airstrikes on Iranian nuclear and military facilities, followed by Iran’s retaliatory ballistic missile launches, have intensified fears of a broader Middle East conflict. Ukraine War: Continued Russian advances and Ukrainian counterstrikes, including attacks on the Crimean Bridge, are sustaining pressure on energy and food prices, contributing to global inflationary risks. China–Taiwan Tensions: China’s military drills around Taiwan — a critical semiconductor hub — are disrupting supply chains and increasing uncertainty across global manufacturing sectors. India–Pakistan Relations: Rising border tensions and diplomatic frictions, particularly around Kashmir, have escalated during 2025, adding further instability to the region. Trade Policy Shifts: President Trump’s renewed focus on aggressive tariff policies has reignited trade tensions, disrupting supply chains and increasing input costs globally. Economic Impacts Across Asset Classes The economic consequences of these geopolitical dynamics are already visible across currencies, commodities, and financial markets. Currencies: The Euro has strengthened against the US Dollar in recent sessions, with EUR/USD trading near 1.15, driven by easing US inflation and expectations of Federal Reserve rate cuts. Commodities: Gold surged to a record high of approximately $3,427 per ounce, reflecting strong demand for safe-haven assets amid escalating geopolitical risks. Oil: Brent crude prices increased by 6–14% following Middle East escalations, with further upside risks linked to potential disruptions in the Strait of Hormuz. Cryptocurrencies: Bitcoin briefly surpassed $110,000 before retracing to around $105,000, reflecting heightened risk sensitivity and geopolitical uncertainty. Equity Markets: The S&P 500 declined approximately 1.13%, falling to around 5,977, while Nasdaq and Dow Jones also recorded losses amid global risk-off sentiment. Structural Global Trends Beyond immediate market reactions, several long-term structural trends are emerging: Militarization: Global defense spending has reached approximately $2.4 trillion, underscoring the persistent shift toward security-driven fiscal priorities. Economic Fragmentation: Intensifying US–China–Russia rivalries and the expansion of BRICS-led initiatives are accelerating deglobalization, with estimates suggesting a potential 3% reduction in global trade. Inflation Risks: Elevated energy prices and renewed tariffs are complicating central banks’ efforts to ease monetary policy, delaying potential rate cuts. Implications for Investors In this environment, traditional assumptions about market stability are being challenged. Investors are increasingly prioritizing: Exposure to safe-haven assets such as gold and selected currencies Diversification across asset classes and geographies Active risk management to mitigate geopolitical shocks Businesses and investors alike must adapt to a world where resilience, flexibility, and strategic allocation are essential for navigating uncertainty. Final Considerations The combination of geopolitical conflict, economic fragmentation, and volatile markets defines the investment landscape of 2025. In such a context, long-term success depends less on short-term reactions and more on structured decision-making, disciplined risk management, and a clear understanding of global dynamics. Original LinkedIn analysis: Read the full discussion on LinkedIn