May 2025 Performance Update: Forex Fund (Aggressive Strategy)

Consistency, discipline, and risk awareness remain central to our investment approach.

The performance recorded by the Forex Fund during May 2025 confirms the effectiveness of a structured strategy even in complex and evolving market conditions.

Throughout the month, INCOME CAPITAL MANAGEMENT continued to deliver solid and measurable results, supported by active management and deep market expertise.

Key Performance Figures

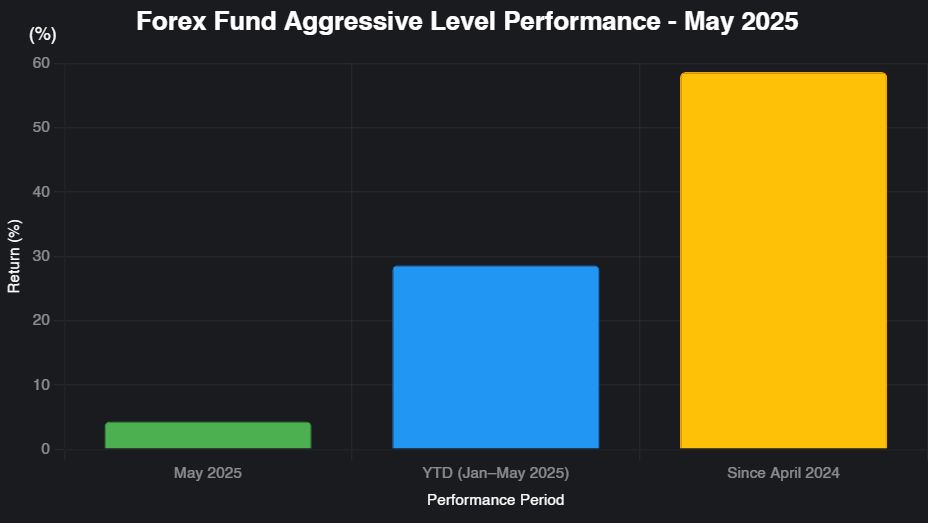

- May 2025: +4.30%

- Year-to-Date (January–May 2025): +28.58%

- Since April 2024 (14 months): +58.63%

These figures reflect a period of sustained performance, achieved through a disciplined exposure framework and continuous monitoring of market dynamics.

Understanding the Results

The Aggressive Level delivered a +4.30% monthly return in May 2025, reinforcing a strong +28.58% YTD performance.

This outcome was driven by a combination of selective positioning, adaptive exposure management, and ongoing risk control.

Rather than relying on directional bets alone, the strategy focuses on identifying high-probability setups while maintaining a robust risk framework — a balance essential in the foreign exchange market.

Longer-Term Perspective

Looking beyond the single month, the performance since April 2024 stands at +58.63%.

This result highlights the capacity of the strategy to generate value over time, even as volatility and macro uncertainty persist.

Higher return potential naturally implies higher risk exposure.

For this reason, disciplined execution and continuous oversight remain fundamental elements of the investment process.

What This Means for Investors

For investors seeking dynamic exposure to the FX market, these results demonstrate how an actively managed approach can deliver consistent outcomes without sacrificing transparency.

Performance is monitored, measured, and communicated clearly — ensuring that results are not only achieved, but also understood.

Real data. Measurable outcomes. No empty promises.

Original LinkedIn post:

View on LinkedIn