INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction

The first half of 2025 has been anything but simple for global financial markets.

Persistent geopolitical tensions, fluctuating monetary policies, and ongoing macroeconomic uncertainty have created an environment where consistency and discipline matter more than bold predictions.

Against this backdrop, INCOME CAPITAL MANAGEMENT delivered a solid and measurable result, confirming the robustness of its investment framework and the effectiveness of its risk-controlled execution.

📊 Strong Performance in a Challenging Environment

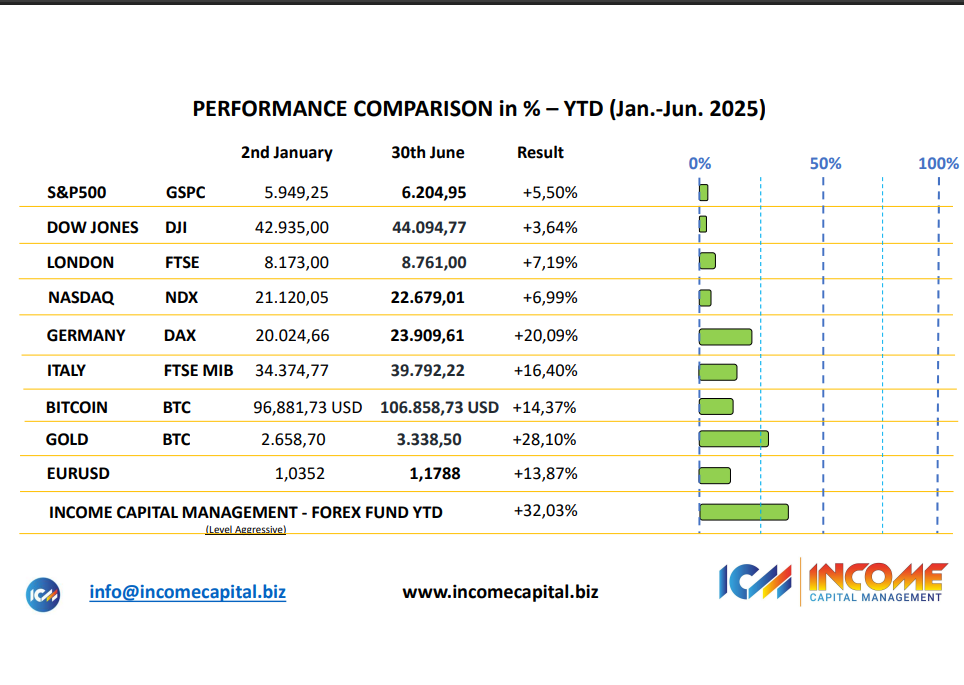

During the first half of 2025, our Aggressive Investment Level achieved:

- +32.03% cumulative return (H1 2025)

- +62.08% cumulative return since April 2024

These figures are not the result of isolated market events or short-term positioning. They reflect a structured and repeatable investment process built around:

- Disciplined FX strategy execution

- Dynamic exposure management

- Continuous risk monitoring and adjustment

- Data-driven decision-making

Past performance refers to the Aggressive Investment Level and is not indicative of future results.

📌 Structure Over Speculation

As highlighted by our Founder & CEO, Paolo Volpicelli, performance is not driven by luck:

“Our edge is not luck — it is structure, conviction, and execution.”

At INCOME CAPITAL MANAGEMENT, we do not attempt to predict markets. Instead, we focus on understanding them, adapting to changing conditions, and maintaining a disciplined framework that prioritizes capital preservation alongside growth.

In an environment where many strategies struggle to remain consistent, our approach continues to demonstrate resilience through methodical positioning and controlled risk exposure.

🔍 Transparency and Measurable Results

We believe that performance should always be:

- Measurable – backed by real data

- Transparent – clearly reported and accessible

- Consistent – aligned with a defined investment process

Our results reflect not only market opportunities but also the strength of a framework designed to operate effectively during both expansionary and volatile phases.

🔗 Further Insights

For the original update and additional context, you can view the LinkedIn article here:

View the original LinkedIn post →

🧠 Looking Ahead

The first half of 2025 reinforces a key principle: in complex markets, conviction and consistency outperform noise and reaction.

As we move into the second half of the year, our focus remains unchanged — protecting capital, managing risk intelligently, and delivering sustainable performance through disciplined execution.

INCOME CAPITAL MANAGEMENT continues to build results through structure, not shortcuts.