Lessons in Crisis Management from 2025 Markets

Lessons in Crisis Management from 2025 Markets Periods of market stress are often remembered for their volatility, but their true value lies in the lessons they reveal. The market dynamics experienced throughout 2025 once again demonstrated how crises test not only portfolios, but also decision-making frameworks, risk discipline, and investor behavior. While every market cycle has its own characteristics, the underlying principles of effective crisis management remain remarkably consistent. Volatility as a Stress Test Market volatility is not an anomaly, it is an intrinsic feature of financial systems. During calmer phases, structural weaknesses may remain hidden. In contrast, periods of stress expose how portfolios are constructed and how risk is truly managed. The volatility observed in 2025 served as a real-time stress test, highlighting the importance of diversification, liquidity awareness, and predefined risk controls. Discipline Over Reaction One of the most common challenges during market turbulence is the temptation to react emotionally. Sudden price movements can lead to decisions driven by fear or urgency rather than analysis. Effective crisis management relies on discipline: the ability to adhere to established frameworks even when market signals appear contradictory or unsettling. Portfolios guided by structured allocation rules and risk parameters are better positioned to absorb shocks without compromising long-term objectives. Preparation Happens Before the Crisis Crises are rarely managed successfully in real time without prior preparation. Portfolio resilience is built during stable periods, through thoughtful asset allocation, scenario analysis, and continuous monitoring. Risk management tools, diversification strategies, and liquidity planning play a critical role long before volatility materializes. When uncertainty rises, preparation allows investors to respond with clarity rather than urgency. The Role of Communication During market stress, communication becomes as important as portfolio construction. Transparent and timely dialogue helps align expectations and reduce the risk of reactive decisions. Clear explanations of portfolio positioning, risk exposure, and strategic intent support investor confidence, even in challenging conditions. Adaptability Within a Framework Discipline does not imply rigidity. Effective crisis management balances adherence to core principles with the flexibility to adapt when structural conditions change. Adjustments made within a coherent framework—rather than impulsive shifts—allow portfolios to remain aligned with long-term goals while responding to evolving market dynamics. Conclusion The lessons from the 2025 markets reinforce a fundamental truth: crisis management is not about predicting the next disruption, but about being prepared when it occurs. Structure, discipline, and clear communication remain the cornerstones of resilient investment management across market cycles. Originally published on LinkedIn: Read the original post on LinkedIn This content is provided for informational purposes only and does not constitute investment advice or a solicitation to the public. Past performance is not indicative of future results.

September 2025 Results: Resilience and Performance in a Volatile Market Environment

September 2025 Results: Resilience and Performance in a Volatile Market Environment “Wake me up when September ends…” sang Green Day. For many investors, September 2025 was indeed a month they would have preferred to skip. Global financial markets experienced exceptional turbulence, elevated uncertainty, and volatility at historically high levels. Gold continued its strong upward trajectory, while geopolitical and macroeconomic developments kept investor sentiment fragile throughout the month. Despite these challenging conditions, our strategies delivered solid positive performance, confirming that discipline, diversification, and a structured risk-based approach can transform uncertainty into opportunity. Market Context: A Month Defined by Volatility September unfolded against a backdrop of persistent geopolitical tension, macroeconomic realignment, and heightened sensitivity to policy signals. In such an environment, markets often reward resilience rather than speculation. Short-term reactions can amplify volatility, while structured strategies focused on risk control tend to demonstrate greater stability. Forex Fund Performance – Aggressive Level Even in this highly unstable context, the Forex Fund (Aggressive Level) closed the month with positive results: September 2025: +2.30% Year-to-date (January–September 2025): +28.16% Cumulative since inception (April 2024): +58.21% Since the beginning of August 2025, the strategy has been managed with a more cautious and prudent approach, reflecting the exceptionally high volatility observed across markets. This adjustment highlights the importance of flexibility within a disciplined framework, allowing portfolios to adapt while maintaining clear risk controls. Real Estate Fund Performance The Real Estate Fund also continued to deliver steady growth during September: September 2025: +0.45% Year-to-date (January–September 2025): +6.44% Cumulative since inception (April 2024): +12.64% While summer months typically represent a slowdown for the real estate sector, activity traditionally resumes with the arrival of autumn. Growth continues to be supported by sustained demand for tangible assets, particularly from investors seeking stability amid broader market uncertainty. Physical Gold Allocation Gold remained a central component of portfolio protection strategies throughout September. Purchased in September: 1.6 kg Total gold in custody: 11.6 kg Market value as of 30/09/2025: €1,228,440 (€105.90 per gram) The increase in demand is consistent with investors’ continued search for protection, reinforced by the strengthening of the spot gold price. In periods of elevated uncertainty, physical gold continues to fulfill its role as a strategic store of value. Transparency and Reporting Detailed performance reports are available at the following link: Access detailed reports → Active clients can find comprehensive data for all managed financial instruments in the private area, under the RESULTS section. Final Considerations September 2025 reinforces a key lesson: in times of heightened uncertainty, resilient strategies grounded in diversification and risk discipline make the difference. While markets remain unpredictable, structured investment approaches continue to demonstrate their ability not only to withstand volatility, but to convert it into sustainable performance. Original LinkedIn post: Read the original update on LinkedIn INCOME CAPITAL MANAGEMENT

July 2025: Extreme Volatility and Forex Fund Performance Under Unprecedented Market Stress

July 2025: Extreme Volatility and Forex Fund Performance Under Unprecedented Market Stress July 2025 proved to be one of the most challenging months in recent financial market history, particularly during its final two weeks. A period that is typically characterized by low volatility and reduced trading activity instead delivered extreme and unpredictable market movements, driven by a combination of political tension, speculative positioning, and fragile liquidity conditions. An Unusual Market Environment The month was dominated by escalating tensions over trade tariffs between Europe and the United States. These developments triggered a rapid sequence of events that destabilized the currency markets, particularly the EUR/USD pair. Initially, the European Central Bank intervened to artificially support the Euro, aiming to strengthen the European Commission’s position during ongoing negotiations. This was followed by a swift resurgence of the US Dollar as the dominant global currency. Crucially, these movements occurred against a backdrop of very low trading volumes, amplifying price swings and resulting in levels of volatility that, in certain moments, were unprecedented—even compared to the 2008 financial crisis. EUR/USD: Exceptional Price Swings The EUR/USD exchange rate illustrated the severity of market dislocation: Such rapid reversals within a compressed timeframe underscore the fragility of market sentiment and the risks associated with speculative flows during low-liquidity periods. Geopolitical Escalation and Risk Perception Market instability was further compounded by emerging geopolitical tensions, including the deployment of US submarines. While the prospect of nuclear escalation remains theoretical, even the suggestion of such risk materially affects investor behavior, volatility expectations, and capital allocation decisions. In environments like this, risk perception often outweighs fundamentals, creating conditions where price movements become disconnected from traditional valuation frameworks. Forex Fund Performance Overview Against this exceptionally turbulent backdrop, the Forex Fund (Aggressive Strategy) recorded the following results: While July closed negatively, the broader performance context remains solid, reflecting the strength of the strategy over longer horizons. Capital Protection as a Priority In periods of extreme and irregular volatility, prudence becomes essential. Our primary objective remains capital protection, with profit generation as a secondary goal. While speculative market movements are inherently unpredictable and beyond direct control, our focus is on maintaining vigilance and preserving the ability to act decisively when conditions normalize. This disciplined approach allows us to manage drawdowns while keeping portfolios positioned for recovery when market dynamics become more rational. Transparency and Reporting A detailed monthly return overview is available in the private area: View the full July 2025 performance report → We believe transparent reporting is essential, especially during challenging phases, enabling investors to evaluate performance within its proper market context. Final Considerations July 2025 serves as a reminder that extreme volatility can emerge even during periods traditionally considered stable. In such environments, discipline, risk management, and a long-term perspective remain the most effective tools for navigating uncertainty. INCOME CAPITAL MANAGEMENT

Managing Volatility in Forex Markets: A Disciplined Investment Framework

Managing Volatility in Forex Markets: A Disciplined Investment Framework Volatility has become a structural feature of global financial markets. In 2025, currency markets in particular have reflected a complex mix of monetary policy divergence, geopolitical tension, and shifting capital flows. For investors, this environment reinforces a simple truth: performance is not driven by prediction, but by process. At INCOME CAPITAL MANAGEMENT, our approach to Forex investing is built around this principle. Rather than reacting to short-term noise, we focus on structured execution, controlled exposure, and continuous risk assessment. The Forex Market in 2025: Complexity, Not Chaos Foreign exchange markets are often perceived as purely speculative. In reality, they are among the most liquid and information-rich markets globally. However, in periods of heightened uncertainty, liquidity alone is not enough. Throughout 2025, FX markets have been influenced by: Diverging interest rate expectations across major economies Persistent geopolitical risk affecting capital allocation Increased correlation between currencies and broader risk assets This backdrop rewards strategies that are adaptive, disciplined, and grounded in measurable risk parameters. A Structured Approach to Forex Exposure Our Forex strategy does not rely on directional bets or discretionary timing. Instead, it is designed to operate through a defined framework that emphasizes: Risk-adjusted positioning, with predefined exposure limits Active management based on evolving market conditions Capital preservation as a core objective, not a secondary consideration Consistency of execution, reducing emotional decision-making This structure allows the strategy to remain operational even when market conditions become less predictable. Why Discipline Matters More Than Direction In volatile markets, attempting to forecast every move often leads to overexposure and inconsistent outcomes. A disciplined framework, by contrast, focuses on managing what can be controlled: risk, position sizing, and execution quality. Our experience confirms that sustainable performance in Forex investing is achieved not by maximizing exposure, but by maintaining flexibility while respecting defined risk constraints. Transparency and Investor Alignment Transparency remains a central pillar of our investment philosophy. Clear reporting, measurable performance, and a well-defined strategy allow investors to understand not only what results are achieved, but how they are generated. In an environment where volatility is likely to persist, clarity and structure become competitive advantages. LinkedIn Source This article is based on the original update published on LinkedIn: View the original LinkedIn post → Looking Forward As global markets continue to evolve, our focus remains unchanged: disciplined execution, robust risk management, and consistent alignment with investor objectives. In Forex markets especially, the ability to navigate volatility with structure—not speculation—will continue to define long-term success. INCOME CAPITAL MANAGEMENT

Global Geopolitical and Economic Outlook 2025: A World in Turmoil

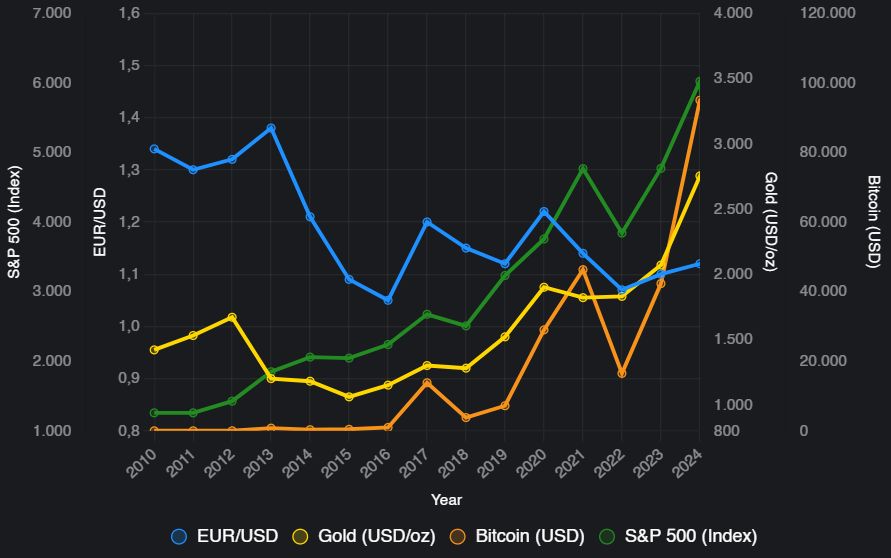

Global Geopolitical and Economic Outlook 2025: A World in Turmoil The global landscape in 2025 is marked by elevated geopolitical tension and economic fragmentation. With the number of active armed conflicts reaching levels unseen since the Second World War, markets are navigating an environment defined by uncertainty, volatility, and structural change. According to current estimates, the world is facing 56 active armed conflicts, a record high that continues to influence economic stability, capital flows, and investor sentiment. Geopolitical Flashpoints Shaping Markets Several regional conflicts and geopolitical developments are playing a decisive role in reshaping global markets: Israel–Iran Escalation: Israel’s recent airstrikes on Iranian nuclear and military facilities, followed by Iran’s retaliatory ballistic missile launches, have intensified fears of a broader Middle East conflict. Ukraine War: Continued Russian advances and Ukrainian counterstrikes, including attacks on the Crimean Bridge, are sustaining pressure on energy and food prices, contributing to global inflationary risks. China–Taiwan Tensions: China’s military drills around Taiwan — a critical semiconductor hub — are disrupting supply chains and increasing uncertainty across global manufacturing sectors. India–Pakistan Relations: Rising border tensions and diplomatic frictions, particularly around Kashmir, have escalated during 2025, adding further instability to the region. Trade Policy Shifts: President Trump’s renewed focus on aggressive tariff policies has reignited trade tensions, disrupting supply chains and increasing input costs globally. Economic Impacts Across Asset Classes The economic consequences of these geopolitical dynamics are already visible across currencies, commodities, and financial markets. Currencies: The Euro has strengthened against the US Dollar in recent sessions, with EUR/USD trading near 1.15, driven by easing US inflation and expectations of Federal Reserve rate cuts. Commodities: Gold surged to a record high of approximately $3,427 per ounce, reflecting strong demand for safe-haven assets amid escalating geopolitical risks. Oil: Brent crude prices increased by 6–14% following Middle East escalations, with further upside risks linked to potential disruptions in the Strait of Hormuz. Cryptocurrencies: Bitcoin briefly surpassed $110,000 before retracing to around $105,000, reflecting heightened risk sensitivity and geopolitical uncertainty. Equity Markets: The S&P 500 declined approximately 1.13%, falling to around 5,977, while Nasdaq and Dow Jones also recorded losses amid global risk-off sentiment. Structural Global Trends Beyond immediate market reactions, several long-term structural trends are emerging: Militarization: Global defense spending has reached approximately $2.4 trillion, underscoring the persistent shift toward security-driven fiscal priorities. Economic Fragmentation: Intensifying US–China–Russia rivalries and the expansion of BRICS-led initiatives are accelerating deglobalization, with estimates suggesting a potential 3% reduction in global trade. Inflation Risks: Elevated energy prices and renewed tariffs are complicating central banks’ efforts to ease monetary policy, delaying potential rate cuts. Implications for Investors In this environment, traditional assumptions about market stability are being challenged. Investors are increasingly prioritizing: Exposure to safe-haven assets such as gold and selected currencies Diversification across asset classes and geographies Active risk management to mitigate geopolitical shocks Businesses and investors alike must adapt to a world where resilience, flexibility, and strategic allocation are essential for navigating uncertainty. Final Considerations The combination of geopolitical conflict, economic fragmentation, and volatile markets defines the investment landscape of 2025. In such a context, long-term success depends less on short-term reactions and more on structured decision-making, disciplined risk management, and a clear understanding of global dynamics. Original LinkedIn analysis: Read the full discussion on LinkedIn

POSITIVE RESULTS DESPITE MARKET WEAKNESS

Positive Results Despite Market Weakness April 2025 unfolded in a challenging market environment, characterized by a broad-based correction across global financial markets. Equity indices faced renewed pressure, with the S&P 500 closing lower for the first time since October, while European and emerging markets also showed visible signs of weakness. In a context marked by uncertainty, tightening financial conditions, and cautious investor sentiment, disciplined portfolio construction and robust risk management once again proved essential. Forex Fund Performance – April 2025 Despite the adverse macroeconomic backdrop, the Forex Fund delivered a solid monthly result: April 2025 performance: +4.25% This performance confirms the effectiveness of the strategic framework implemented since the launch of the fund and highlights the importance of adaptability during volatile market phases. Key Drivers Behind the Performance The April result reflects a combination of structural discipline and tactical flexibility embedded in the investment process: Active selection of resilient instruments and market segments, prioritizing liquidity and risk-adjusted returns Dynamic exposure management, adapting positioning as market conditions evolved Continuous focus on risk management, aimed at preserving capital during periods of heightened volatility Rather than relying on short-term directional bets, the strategy emphasized consistency, adaptability, and disciplined execution. Strategy Over Market Noise Periods like April reinforce a fundamental investment principle: sustainable results are driven by structure, discipline, and execution—not by reactive decision-making. In complex and unstable environments, maintaining a clear framework and a flexible approach often makes the difference between protecting capital and amplifying risk. Client Experience – Monaco Grand Prix 2025 April was also a meaningful month beyond portfolio performance. Following the April 8th webinar, selected clients confirmed their participation in the Formula 1 Monaco Grand Prix, scheduled for May 24–25, 2025. This exclusive event represents an opportunity to share a unique experience together, strengthening long-term relationships built on trust, transparency, and shared vision. Photos and highlights from the event will be shared in our upcoming newsletter. Conclusion April 2025 once again demonstrated that well-structured strategies, disciplined risk control, and adaptability remain essential pillars for navigating uncertain financial markets. We are pleased to share both performance results and meaningful moments with clients who continue to place long-term trust in our investment approach. Related LinkedIn Post For a concise market update and additional context, you can view the original LinkedIn post here:Positive Results Despite Market Weakness – LinkedIn