September 2025 Results: Resilience and Performance in a Volatile Market Environment

September 2025 Results: Resilience and Performance in a Volatile Market Environment “Wake me up when September ends…” sang Green Day. For many investors, September 2025 was indeed a month they would have preferred to skip. Global financial markets experienced exceptional turbulence, elevated uncertainty, and volatility at historically high levels. Gold continued its strong upward trajectory, while geopolitical and macroeconomic developments kept investor sentiment fragile throughout the month. Despite these challenging conditions, our strategies delivered solid positive performance, confirming that discipline, diversification, and a structured risk-based approach can transform uncertainty into opportunity. Market Context: A Month Defined by Volatility September unfolded against a backdrop of persistent geopolitical tension, macroeconomic realignment, and heightened sensitivity to policy signals. In such an environment, markets often reward resilience rather than speculation. Short-term reactions can amplify volatility, while structured strategies focused on risk control tend to demonstrate greater stability. Forex Fund Performance – Aggressive Level Even in this highly unstable context, the Forex Fund (Aggressive Level) closed the month with positive results: September 2025: +2.30% Year-to-date (January–September 2025): +28.16% Cumulative since inception (April 2024): +58.21% Since the beginning of August 2025, the strategy has been managed with a more cautious and prudent approach, reflecting the exceptionally high volatility observed across markets. This adjustment highlights the importance of flexibility within a disciplined framework, allowing portfolios to adapt while maintaining clear risk controls. Real Estate Fund Performance The Real Estate Fund also continued to deliver steady growth during September: September 2025: +0.45% Year-to-date (January–September 2025): +6.44% Cumulative since inception (April 2024): +12.64% While summer months typically represent a slowdown for the real estate sector, activity traditionally resumes with the arrival of autumn. Growth continues to be supported by sustained demand for tangible assets, particularly from investors seeking stability amid broader market uncertainty. Physical Gold Allocation Gold remained a central component of portfolio protection strategies throughout September. Purchased in September: 1.6 kg Total gold in custody: 11.6 kg Market value as of 30/09/2025: €1,228,440 (€105.90 per gram) The increase in demand is consistent with investors’ continued search for protection, reinforced by the strengthening of the spot gold price. In periods of elevated uncertainty, physical gold continues to fulfill its role as a strategic store of value. Transparency and Reporting Detailed performance reports are available at the following link: Access detailed reports → Active clients can find comprehensive data for all managed financial instruments in the private area, under the RESULTS section. Final Considerations September 2025 reinforces a key lesson: in times of heightened uncertainty, resilient strategies grounded in diversification and risk discipline make the difference. While markets remain unpredictable, structured investment approaches continue to demonstrate their ability not only to withstand volatility, but to convert it into sustainable performance. Original LinkedIn post: Read the original update on LinkedIn INCOME CAPITAL MANAGEMENT

July 2025: Extreme Volatility and Forex Fund Performance Under Unprecedented Market Stress

July 2025: Extreme Volatility and Forex Fund Performance Under Unprecedented Market Stress July 2025 proved to be one of the most challenging months in recent financial market history, particularly during its final two weeks. A period that is typically characterized by low volatility and reduced trading activity instead delivered extreme and unpredictable market movements, driven by a combination of political tension, speculative positioning, and fragile liquidity conditions. An Unusual Market Environment The month was dominated by escalating tensions over trade tariffs between Europe and the United States. These developments triggered a rapid sequence of events that destabilized the currency markets, particularly the EUR/USD pair. Initially, the European Central Bank intervened to artificially support the Euro, aiming to strengthen the European Commission’s position during ongoing negotiations. This was followed by a swift resurgence of the US Dollar as the dominant global currency. Crucially, these movements occurred against a backdrop of very low trading volumes, amplifying price swings and resulting in levels of volatility that, in certain moments, were unprecedented—even compared to the 2008 financial crisis. EUR/USD: Exceptional Price Swings The EUR/USD exchange rate illustrated the severity of market dislocation: Such rapid reversals within a compressed timeframe underscore the fragility of market sentiment and the risks associated with speculative flows during low-liquidity periods. Geopolitical Escalation and Risk Perception Market instability was further compounded by emerging geopolitical tensions, including the deployment of US submarines. While the prospect of nuclear escalation remains theoretical, even the suggestion of such risk materially affects investor behavior, volatility expectations, and capital allocation decisions. In environments like this, risk perception often outweighs fundamentals, creating conditions where price movements become disconnected from traditional valuation frameworks. Forex Fund Performance Overview Against this exceptionally turbulent backdrop, the Forex Fund (Aggressive Strategy) recorded the following results: While July closed negatively, the broader performance context remains solid, reflecting the strength of the strategy over longer horizons. Capital Protection as a Priority In periods of extreme and irregular volatility, prudence becomes essential. Our primary objective remains capital protection, with profit generation as a secondary goal. While speculative market movements are inherently unpredictable and beyond direct control, our focus is on maintaining vigilance and preserving the ability to act decisively when conditions normalize. This disciplined approach allows us to manage drawdowns while keeping portfolios positioned for recovery when market dynamics become more rational. Transparency and Reporting A detailed monthly return overview is available in the private area: View the full July 2025 performance report → We believe transparent reporting is essential, especially during challenging phases, enabling investors to evaluate performance within its proper market context. Final Considerations July 2025 serves as a reminder that extreme volatility can emerge even during periods traditionally considered stable. In such environments, discipline, risk management, and a long-term perspective remain the most effective tools for navigating uncertainty. INCOME CAPITAL MANAGEMENT

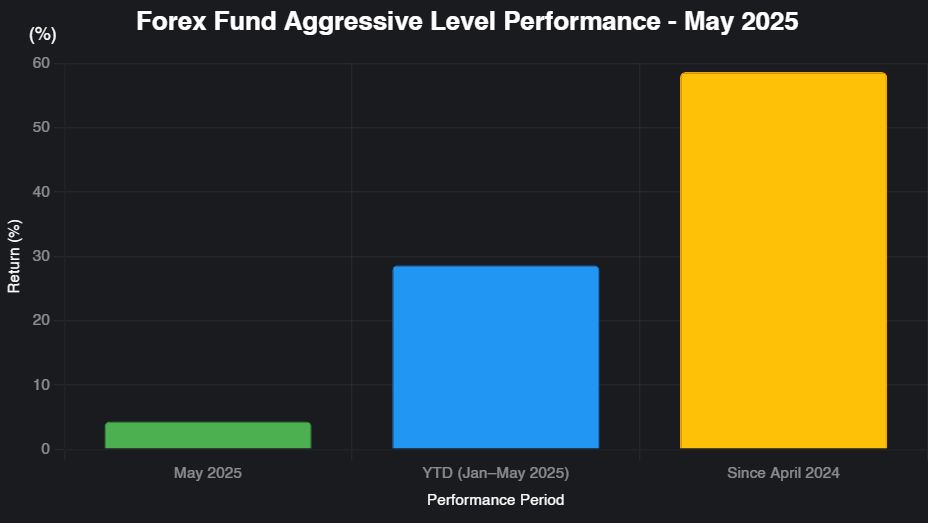

May 2025 Performance Update: Forex Fund (Aggressive Strategy)

May 2025 Performance Update: Forex Fund (Aggressive Strategy) Consistency, discipline, and risk awareness remain central to our investment approach. The performance recorded by the Forex Fund during May 2025 confirms the effectiveness of a structured strategy even in complex and evolving market conditions. Throughout the month, INCOME CAPITAL MANAGEMENT continued to deliver solid and measurable results, supported by active management and deep market expertise. Key Performance Figures May 2025: +4.30% Year-to-Date (January–May 2025): +28.58% Since April 2024 (14 months): +58.63% These figures reflect a period of sustained performance, achieved through a disciplined exposure framework and continuous monitoring of market dynamics. Understanding the Results The Aggressive Level delivered a +4.30% monthly return in May 2025, reinforcing a strong +28.58% YTD performance. This outcome was driven by a combination of selective positioning, adaptive exposure management, and ongoing risk control. Rather than relying on directional bets alone, the strategy focuses on identifying high-probability setups while maintaining a robust risk framework — a balance essential in the foreign exchange market. Longer-Term Perspective Looking beyond the single month, the performance since April 2024 stands at +58.63%. This result highlights the capacity of the strategy to generate value over time, even as volatility and macro uncertainty persist. Higher return potential naturally implies higher risk exposure. For this reason, disciplined execution and continuous oversight remain fundamental elements of the investment process. What This Means for Investors For investors seeking dynamic exposure to the FX market, these results demonstrate how an actively managed approach can deliver consistent outcomes without sacrificing transparency. Performance is monitored, measured, and communicated clearly — ensuring that results are not only achieved, but also understood. Real data. Measurable outcomes. No empty promises. Original LinkedIn post: View on LinkedIn

POSITIVE RESULTS DESPITE MARKET WEAKNESS

Positive Results Despite Market Weakness April 2025 unfolded in a challenging market environment, characterized by a broad-based correction across global financial markets. Equity indices faced renewed pressure, with the S&P 500 closing lower for the first time since October, while European and emerging markets also showed visible signs of weakness. In a context marked by uncertainty, tightening financial conditions, and cautious investor sentiment, disciplined portfolio construction and robust risk management once again proved essential. Forex Fund Performance – April 2025 Despite the adverse macroeconomic backdrop, the Forex Fund delivered a solid monthly result: April 2025 performance: +4.25% This performance confirms the effectiveness of the strategic framework implemented since the launch of the fund and highlights the importance of adaptability during volatile market phases. Key Drivers Behind the Performance The April result reflects a combination of structural discipline and tactical flexibility embedded in the investment process: Active selection of resilient instruments and market segments, prioritizing liquidity and risk-adjusted returns Dynamic exposure management, adapting positioning as market conditions evolved Continuous focus on risk management, aimed at preserving capital during periods of heightened volatility Rather than relying on short-term directional bets, the strategy emphasized consistency, adaptability, and disciplined execution. Strategy Over Market Noise Periods like April reinforce a fundamental investment principle: sustainable results are driven by structure, discipline, and execution—not by reactive decision-making. In complex and unstable environments, maintaining a clear framework and a flexible approach often makes the difference between protecting capital and amplifying risk. Client Experience – Monaco Grand Prix 2025 April was also a meaningful month beyond portfolio performance. Following the April 8th webinar, selected clients confirmed their participation in the Formula 1 Monaco Grand Prix, scheduled for May 24–25, 2025. This exclusive event represents an opportunity to share a unique experience together, strengthening long-term relationships built on trust, transparency, and shared vision. Photos and highlights from the event will be shared in our upcoming newsletter. Conclusion April 2025 once again demonstrated that well-structured strategies, disciplined risk control, and adaptability remain essential pillars for navigating uncertain financial markets. We are pleased to share both performance results and meaningful moments with clients who continue to place long-term trust in our investment approach. Related LinkedIn Post For a concise market update and additional context, you can view the original LinkedIn post here:Positive Results Despite Market Weakness – LinkedIn