Annual Investment Report – 2025

Annual Investment Report – 2025 INCOME CAPITAL MANAGEMENT informs all clients that the Annual Investment Report for the year 2025 is available for consultation and printing directly from the Private Client Area. Within the dedicated investment section, each client can view a comprehensive overview of their positions, including performance data, invested capital, and operational configurations, with information updated according to the reporting frequency applicable to each fund. Formal Annual Report Request Clients who wish to receive the official Annual Investment Report for 2025, formally issued by Income Capital Management s.r.o., are kindly requested to submit their request by email to: 📧 investors@incomecapital.biz Please ensure that the email includes the relevant Client ID (or Client IDs, in the case of multiple investments) for which the report is requested. The document will be prepared and delivered in accordance with internal verification and compliance procedures. Return Update Frequency Investment returns displayed on the investment page are updated according to the following schedule: Weekly for the FOREX FUND Monthly for all other funds (typically by the 4th day of the following month) If an investment did not start at the beginning of a standard quarter (January, April, July, October), returns are calculated and displayed on a pro-rata basis. Explanation of Table Fields Below is a description of the main fields displayed in the investment summary table: CLIENT ID: The client identification number assigned by Income Capital Management s.r.o. Clients with multiple investments will have multiple Client IDs. END DATE: The maturity or expiration date of the investment. FUND: The type of investment subscribed. GUARANTEED CAPITAL: The percentage of capital guaranteed, where applicable. WORKING AMOUNT: The operating capital on which returns are calculated. This amount does not include any reinvested profits. RANGE: The indicative annual return range, reflecting the risk level of the selected investment. Q1, Q2, Q3, Q4: Percentage and monetary value of any profit generated in the respective quarter, if applicable. YEARLY TOTAL: Total annual profit expressed as both a percentage and an amount in EUR. For clients who do not reinvest profits quarterly, this figure is shown only for the current quarter. CAPITAL + INVESTMENT: The total amount in EUR consisting of invested capital plus any profits generated during the year. REINVESTED PROFITS ON QUARTERLY BASIS: Indicates whether quarterly profit reinvestment has been selected. PAC AMOUNT ON QUARTERLY BASIS: Indicates whether a quarterly Capital Accumulation Plan (PAC) is active and the selected contribution amount. Support and Clarifications The team at INCOME CAPITAL MANAGEMENT remains fully available for any clarification or additional information regarding the annual report, investment data, or portfolio configurations. Kind regards, INCOME CAPITAL MANAGEMENT s.r.o.

INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction

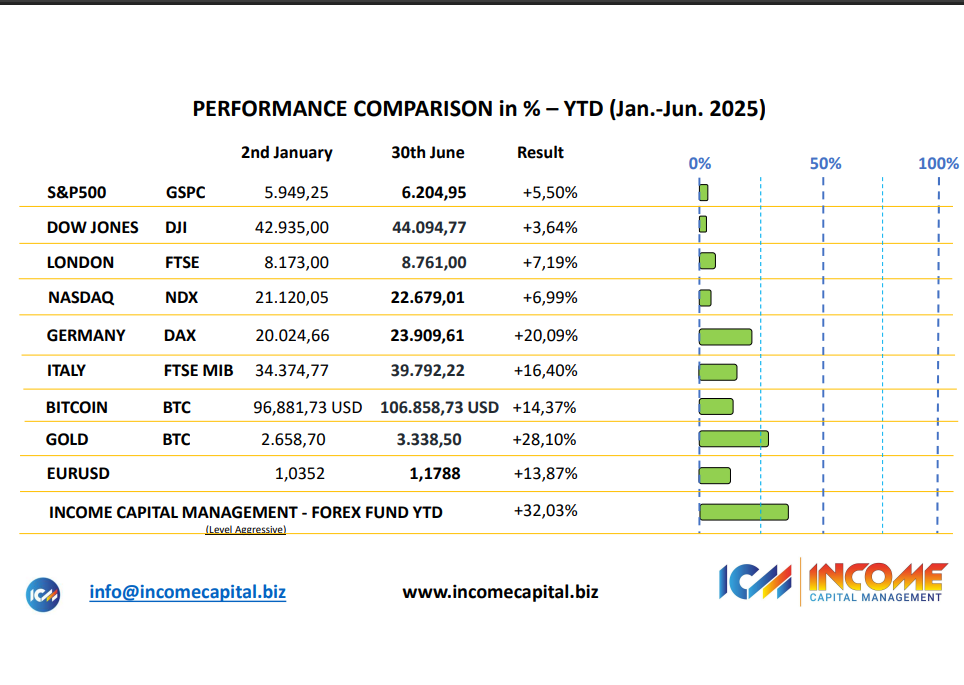

INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction The first half of 2025 has been anything but simple for global financial markets. Persistent geopolitical tensions, fluctuating monetary policies, and ongoing macroeconomic uncertainty have created an environment where consistency and discipline matter more than bold predictions. Against this backdrop, INCOME CAPITAL MANAGEMENT delivered a solid and measurable result, confirming the robustness of its investment framework and the effectiveness of its risk-controlled execution. 📊 Strong Performance in a Challenging Environment During the first half of 2025, our Aggressive Investment Level achieved: +32.03% cumulative return (H1 2025) +62.08% cumulative return since April 2024 These figures are not the result of isolated market events or short-term positioning. They reflect a structured and repeatable investment process built around: Disciplined FX strategy execution Dynamic exposure management Continuous risk monitoring and adjustment Data-driven decision-making Past performance refers to the Aggressive Investment Level and is not indicative of future results. 📌 Structure Over Speculation As highlighted by our Founder & CEO, Paolo Volpicelli, performance is not driven by luck: “Our edge is not luck — it is structure, conviction, and execution.” At INCOME CAPITAL MANAGEMENT, we do not attempt to predict markets. Instead, we focus on understanding them, adapting to changing conditions, and maintaining a disciplined framework that prioritizes capital preservation alongside growth. In an environment where many strategies struggle to remain consistent, our approach continues to demonstrate resilience through methodical positioning and controlled risk exposure. 🔍 Transparency and Measurable Results We believe that performance should always be: Measurable – backed by real data Transparent – clearly reported and accessible Consistent – aligned with a defined investment process Our results reflect not only market opportunities but also the strength of a framework designed to operate effectively during both expansionary and volatile phases. 🔗 Further Insights For the original update and additional context, you can view the LinkedIn article here: View the original LinkedIn post → 🧠 Looking Ahead The first half of 2025 reinforces a key principle: in complex markets, conviction and consistency outperform noise and reaction. As we move into the second half of the year, our focus remains unchanged — protecting capital, managing risk intelligently, and delivering sustainable performance through disciplined execution. INCOME CAPITAL MANAGEMENT continues to build results through structure, not shortcuts.

Navigating Storms, Delivering Solid Results: Our First Half of 2025

Navigating Storms, Delivering Solid Results: Our First Half of 2025 The first half of 2025 has tested investors worldwide. Geopolitical tensions, persistent inflationary pressures, and volatile global markets have created an environment where consistency has been difficult to achieve and true outperformance even harder. Yet it is precisely during these phases that disciplined investment strategies reveal their value. A Market Environment Defined by Complexity The past six months can reasonably be described as a period of global instability. Financial markets have had to absorb overlapping shocks — from geopolitical uncertainty and shifting monetary policies to sudden changes in risk sentiment. In such an environment, remaining invested is not enough. Navigating volatility requires clarity of process, disciplined execution, and the ability to distinguish noise from structural opportunity. Performance That Reflects Method, Not Momentum At Income Capital Management, we do not aim to react to markets — we aim to understand them, structure around them, and outperform them through disciplined strategy. As we close the first half of 2025, the results of this approach are clearly visible: June 2025: +3.45% Q2 2025: +12.00% Year-to-Date (Jan–Jun 2025): +32.03% Cumulative since April 2024: +62.08% These figures refer to the Aggressive Investment Level of our flagship Forex strategy. As always, it is important to note that past performance is not indicative of future results. Why These Results Matter Outperformance in a strong market can be attributed to momentum. Outperformance in a fragile and uncertain market, however, reflects structure, risk control, and execution. Our results are the outcome of: A proprietary FX strategy built on active market analysis Disciplined risk management and exposure control Flexibility in adapting to rapidly changing market conditions Continuous focus on capital protection alongside return generation While many investors struggled to remain invested amid volatility, our strategy maintained coherence and direction. Conviction Over Noise Periods dominated by political headlines, central bank speculation, and short-term market reactions often tempt investors to abandon strategy in favor of emotion. We believe the opposite approach is required. In complex environments, capital seeks conviction, consistency, and process — not narratives. This philosophy has guided our decisions throughout the first half of 2025 and continues to shape our outlook for the months ahead. A Message to Investors To our investors, we extend our sincere appreciation for your continued trust. Your confidence allows us to execute strategies with discipline and long-term perspective. For those observing from the sidelines, this period serves as a reminder that sustainable performance is built through method, not speculation. A performance comparison chart related to this update is available on LinkedIn at the following link: View the performance update on LinkedIn As markets continue to evolve, our commitment remains unchanged: protecting capital, managing risk, and delivering consistent, transparent results.

Investment Returns: €10,000 Then vs Now — A 10-Year Comparison

Investment Returns: €10,000 Then vs Now — A 10-Year Comparison Time is one of the most powerful variables in investing. Looking back over the past decade, the difference between asset classes becomes striking when performance is measured over a full market cycle rather than short-term movements. This analysis addresses a simple but fundamental question: What would €10,000 invested ten years ago be worth today? The comparison below highlights how different assets have behaved over time, illustrating the impact of growth, volatility, and risk management. Stock Market Indices Equity markets delivered solid long-term growth, with notable differences between regions. NASDAQ Composite: approximately +261% over 10 years S&P 500: approximately +170% over 10 years FTSE 100 (London): approximately +45% over 10 years FTSE MIB (Milan): approximately +50% over 10 years The data confirms the structural outperformance of U.S. markets, largely driven by technology and innovation-led growth. Individual Stocks Selecting individual equities amplified returns significantly, while also increasing volatility and concentration risk. Amazon: approximately +1,561% over 10 years Apple: approximately +1,193% over 10 years Microsoft: approximately +1,334% over 10 years Alphabet (Google): approximately +872% over 10 years Tesla: approximately +13,895% over 10 years These outcomes highlight the power of innovation — and the importance of managing downside risk when exposure is concentrated. Bitcoin Bitcoin represents the most extreme example of asymmetric risk and return. Bitcoin: approximately +39,800% over 10 years Such performance came with extreme volatility, sharp drawdowns, and regulatory uncertainty — factors that require careful sizing within a diversified portfolio. Gold Gold continued to serve as a long-term store of value and defensive asset. Gold: approximately +126% total return over 10 years While returns were lower than equities, gold provided stability during periods of inflation and market stress. Real Estate (Value Appreciation) Property markets delivered mixed results depending on geography and local fundamentals. New York: approximately +35% over 10 years London: approximately +40% over 10 years Milan: approximately +25% over 10 years Dubai: approximately +90% over 10 years Dubai stands out for its strong appreciation, supported by international capital flows and favorable economic policies. The Income Capital Forex Fund Perspective Based on historical assumptions, a €10,000 investment in the Income Capital Forex Fund over the same ten-year horizon would have generated approximately +500%. This performance would place the strategy: Above traditional equity indices Well ahead of gold and most real estate markets Below high-volatility assets such as Bitcoin The differentiating factor remains a disciplined framework combining active management, structured risk control, and consistent execution. Key Takeaways High Risk, High Reward: Crypto and select equities delivered exceptional returns, but with extreme volatility. Technology Leadership: Innovation-driven companies reshaped long-term equity performance. Stability vs Growth: Gold and real estate offered resilience rather than explosive growth. Diversification Matters: Balanced portfolios reduce volatility while preserving long-term opportunity. Final Consideration Investment success is not about chasing the best-performing asset, but about constructing a portfolio that aligns risk, time horizon, and objectives. Consistency, diversification, and discipline remain the foundations of long-term capital growth. Original LinkedIn post: View the discussion on LinkedIn

INCOME CAPITAL FOREX FUND – Questions & Answers (April 2024)

INCOME CAPITAL FOREX FUND – Questions & Answers (April 2024) What is the INCOME CAPITAL FOREX Fund? The INCOME CAPITAL FOREX Fund is an investment fund managed by INCOME CAPITAL MANAGEMENT s.r.o. that operates in the global foreign exchange (FX) market. Its objective is capital appreciation through active currency trading using a structured and risk-controlled approach. What does the Fund invest in? The Fund trades major currency pairs, primarily: EUR/USD EUR/GBP GBP/USD Trading activity is focused on liquid FX markets, allowing efficient execution and continuous risk monitoring. What is the investment objective of the Fund? The objective is to generate returns through active forex trading while applying disciplined risk management. The Fund does not aim to guarantee profits and does not eliminate market risk. What type of strategy does the Fund use? The Fund adopts an active trading strategy with a scalping-oriented approach, meaning it takes advantage of short-term price movements in the currency markets. Investment decisions are supported by: Fundamental analysis (macroeconomic data, interest rates, geopolitical events) Technical analysis (price patterns, market behavior) Technology-supported execution systems Does the Fund use Artificial Intelligence? Yes. The Fund uses AI and algorithmic tools to support market analysis and trade execution. AI is used to: Analyze large datasets of historical and live market data Identify patterns and market signals Support decision-making and execution efficiency AI does not operate independently and is always subject to human oversight and risk controls. Who manages the Fund? The Fund is managed by professional fund managers supported by financial analysts, automated trading systems (Expert Advisors), and risk management and compliance teams. Human supervision remains central to the investment process. What is the risk level of the Forex Fund? The Forex Fund has a medium-to-high risk profile. Foreign exchange markets are volatile, and losses can occur, including partial or total loss of invested capital depending on the investment level chosen. What are the main risks involved? Key risks include: Market and volatility risk Currency risk Liquidity risk Technological and system risk Operational and regulatory risk Investors should carefully assess their risk tolerance before investing. How does the Fund manage risk? Risk management measures include position sizing rules, stop-loss mechanisms, continuous monitoring of market exposure, diversification of trading positions, and compliance with regulatory standards. Risk is actively managed but cannot be eliminated. Are there different investment levels? Yes. The Fund offers four investment levels: Conservative – lower risk, partial capital protection, lower return range Mild-Conservative – balanced approach between risk and protection Mild-Aggressive – higher risk with higher potential returns Aggressive – highest risk and highest return potential Each level has a defined expected return range and capital protection structure, where applicable. Is capital guaranteed? Capital protection depends on the selected investment level. Some levels offer partial capital protection, while others are fully exposed to market risk. Capital is never fully guaranteed. How often are returns updated? Returns are updated weekly for the Forex Fund. Performance is calculated based on the working amount invested. Returns may vary depending on market conditions. What fees apply to the Forex Fund? There are no entry fees and no fixed management fees. A performance fee is applied only on realized net profits. Compliance-related onboarding costs (KYC/AML) are borne by the investor. Can an investor exit before maturity? Yes. Early exit is possible under predefined conditions. Fees or penalties may apply depending on the investment level, duration of the investment, and timing of the withdrawal. Details are specified in the official documentation. Who can invest in the Forex Fund? The Fund is intended for investors who understand financial markets and FX trading risks, are comfortable with medium-to-high risk investments, and have a medium to long-term investment horizon. The Fund may not be suitable for all investors. Is the Fund regulated? Yes. INCOME CAPITAL MANAGEMENT s.r.o. operates under the supervision of the Czech National Bank, in accordance with applicable regulations. All investors are subject to KYC, AML, and PEP checks. How is transparency ensured? Transparency is ensured through regular performance reporting, access to investment data via the private client area, dedicated investor support, and clear documentation outlining risks, fees, and strategy. Where can investors find official documentation? Official documentation, including the KID, is provided during onboarding and is available upon request from INCOME CAPITAL MANAGEMENT. Is this information investment advice? No. This information is provided for educational and informational purposes only and does not constitute investment advice. Investors should seek independent professional advice before making any investment decision.