Cryptocurrency and Digital Assets: Income Capital Management’s Measured Approach

Cryptocurrency and Digital Assets: Income Capital Management’s Measured Approach Cryptocurrencies and digital assets continue to attract global attention, oscillating between innovation-driven enthusiasm and periods of extreme volatility. While the sector remains highly speculative, the underlying blockchain technology is undeniably reshaping financial infrastructure, asset ownership models, and transaction efficiency. At Income Capital Management, we approach cryptocurrencies and digital assets with a clear distinction between technological innovation and investable opportunity. Our philosophy is not driven by hype or short-term price movements, but by a disciplined risk–return framework designed to protect capital while selectively capturing long-term value. Volatility and Speculation: Understanding the Risk Profile Digital assets are characterized by sharp price fluctuations, regulatory uncertainty, and evolving market structures. These factors make cryptocurrencies unsuitable as core holdings for many portfolios, particularly when risk tolerance and capital preservation are primary objectives. For this reason, Income Capital Management avoids excessive or unstructured exposure to cryptocurrencies. Instead, we analyze digital assets within the broader context of portfolio construction, assessing their impact on volatility, correlation, liquidity, and drawdown risk. Blockchain Beyond Cryptocurrencies While cryptocurrencies themselves remain speculative, blockchain technology represents a structural innovation with tangible applications. Tokenized securities, decentralized settlement systems, and distributed ledger infrastructure are already influencing how financial markets operate. Our focus extends beyond individual digital currencies to the ecosystem that supports them. This includes evaluating opportunities linked to blockchain infrastructure, regulated tokenization frameworks, and institutional-grade digital asset solutions where transparency, governance, and compliance are clearly defined. A Selective and Disciplined Allocation Income Capital Management integrates digital assets only where they enhance diversification without compromising portfolio stability. Any exposure is carefully sized, continuously monitored, and aligned with each client’s risk profile and long-term objectives. This measured approach allows us to remain engaged with innovation while maintaining strict control over downside risk. Innovation is valuable only when it is supported by structure, discipline, and clear investment rationale. Innovation with Responsibility The future of finance will undoubtedly include digital assets and blockchain-based solutions. However, sustainable wealth creation requires more than technological enthusiasm. It demands robust risk management, regulatory awareness, and a long-term perspective. At Income Capital Management, we believe that innovation and prudence are not opposites — they are complementary pillars of responsible asset management. LinkedIn post: https://www.linkedin.com/feed/update/urn:li:activity:7420389889122193408

PRESS RELEASE – TEARLY RESULTS 2025

Income Capital Management Reports Strong 2025 Performance in a Year of Divergent Global Markets FOR IMMEDIATE RELEASE Date: January 27, 2026 Prague, Czech Republic — Income Capital Management closed 2025 with solid results across its diversified investment strategies, successfully navigating a year marked by sharp divergences between asset classes. The firm enters 2026 with a disciplined, multi-asset approach focused on delivering consistent value to its investors. Market Environment Global markets in 2025 were characterized by pronounced dispersion. Gold emerged as the top-performing major asset class, posting gains of +65.87% and reinforcing its role as a safe-haven asset. Major equity indices, including DAX, NASDAQ, FTSE 100, Euro Stoxx 50, S&P 500, and Dow Jones, recorded positive performances, while Bitcoin declined by -6.35%, reflecting increased volatility and speculative risk. Italy’s FTSE MIB underperformed relative to broader international benchmarks. Key Strategy Performance Income Capital Management’s Forex strategy delivered a standout performance, achieving an annual return of +34.98%. Active currency trading combined with strict risk management allowed the strategy to outperform major traditional benchmarks. The firm’s Real Estate strategy generated stable income-driven returns of +7.71%, supported by premium property assets and consistent cash flow, outperforming several weaker regional equity markets. Additional allocations to global growth and high-yield strategies contributed to overall portfolio diversification and balance. Management Commentary “2025 confirmed that active and diversified strategies are essential in fragmented market conditions,” said Paolo Volpicelli, CEO of Income Capital Management. “Our Forex strategy’s 34.98% return demonstrates how disciplined execution and controlled risk can translate into meaningful performance for our investors.” Nicola Pinchi, CTO of Income Capital Management, added: “By combining high-conviction Forex strategies with stable real estate income and physical gold exposure, we have built portfolios designed to perform across different market cycles rather than simply follow short-term trends.” Strategic Positioning for 2026 Income Capital Management’s multi-asset framework — encompassing Forex for growth, real estate for income, global growth and high-yield strategies for diversification, and physical gold for capital protection — is designed to provide resilience and flexibility in an evolving macroeconomic environment. As the firm enters 2026, this structure aims to balance opportunity and risk, supporting long-term portfolio stability in periods of heightened volatility. About Income Capital Management Income Capital Management is an independent asset management firm specializing in diversified investment solutions across Forex, real estate, global growth, high-yield strategies, and physical asset exposure. The firm focuses on active management, disciplined risk control, and long-term capital preservation and growth. For more information, please visit www.incomecapital.biz or contact the Income Capital Management team directly. LinkedIn press release: https://www.linkedin.com/posts/paolovolpicelli_press-release-tearly-results-2025-activity-7421816797093494784-NoVd

Confidence, Emerging Markets and Debt Investment: Navigating Opportunity Through Structure

Confidence, Emerging Markets and Debt Investment: Navigating Opportunity Through Structure In a global financial environment shaped by uncertainty, confidence is not a sentiment — it is the result of structure, discipline, and informed decision-making. Emerging markets continue to attract investor attention, not because they are simple, but because they offer opportunities that are often uncorrelated with traditional developed markets. Within this context, debt investments play a strategic role, combining yield potential with structured risk management when approached correctly. Why Confidence Matters in Emerging Markets Emerging markets are frequently associated with volatility, political risk, and uneven growth cycles. While these factors are real, they also create inefficiencies — and inefficiencies are precisely where disciplined investors can find value. Confidence in this space does not come from speculation. It comes from: Careful jurisdiction and counterparty selection Clear legal and regulatory frameworks Defined risk parameters and exit strategies Continuous monitoring of macroeconomic and geopolitical dynamics When these elements are in place, emerging market exposure becomes a calculated allocation rather than a leap of faith. The Strategic Role of Debt Investment Debt investment represents a different approach compared to pure equity exposure. Instead of relying solely on growth narratives, debt strategies focus on contractual cash flows, capital structure positioning, and downside protection. In emerging markets, this approach can be particularly effective. Well-structured debt instruments may offer: Predictable income streams Priority positioning in the capital structure Lower volatility compared to equity investments Improved portfolio diversification The key lies in rigorous due diligence and conservative structuring — elements that transform complexity into opportunity. From Perceived Risk to Managed Exposure Risk in emerging markets is often misunderstood. The real risk is not volatility itself, but the absence of controls, transparency, and governance. By focusing on structured debt solutions, investors can access emerging market opportunities while maintaining alignment with capital preservation objectives. This approach shifts the narrative from speculative exposure to intentional allocation. Confidence as a Competitive Advantage In periods where global markets oscillate between optimism and fear, confidence becomes a differentiating factor. Not blind confidence, but informed confidence — built on data, structure, and experience. At INCOME CAPITAL MANAGEMENT, confidence is the outcome of method. Our investment philosophy emphasizes clarity over complexity and structure over narratives, particularly when operating in less conventional markets. A Measured Path Forward Emerging markets and debt investments are not designed for short-term speculation. They are components of a broader strategy aimed at diversification, income generation, and long-term resilience. By combining disciplined risk management with selective exposure, it is possible to navigate complexity without compromising on control. INCOME CAPITAL MANAGEMENT s.r.o. 🔗 Related LinkedIn post: Confidence, Emerging Markets and Debt Investment

Annual Investment Report – 2025

Annual Investment Report – 2025 INCOME CAPITAL MANAGEMENT informs all clients that the Annual Investment Report for the year 2025 is available for consultation and printing directly from the Private Client Area. Within the dedicated investment section, each client can view a comprehensive overview of their positions, including performance data, invested capital, and operational configurations, with information updated according to the reporting frequency applicable to each fund. Formal Annual Report Request Clients who wish to receive the official Annual Investment Report for 2025, formally issued by Income Capital Management s.r.o., are kindly requested to submit their request by email to: 📧 investors@incomecapital.biz Please ensure that the email includes the relevant Client ID (or Client IDs, in the case of multiple investments) for which the report is requested. The document will be prepared and delivered in accordance with internal verification and compliance procedures. Return Update Frequency Investment returns displayed on the investment page are updated according to the following schedule: Weekly for the FOREX FUND Monthly for all other funds (typically by the 4th day of the following month) If an investment did not start at the beginning of a standard quarter (January, April, July, October), returns are calculated and displayed on a pro-rata basis. Explanation of Table Fields Below is a description of the main fields displayed in the investment summary table: CLIENT ID: The client identification number assigned by Income Capital Management s.r.o. Clients with multiple investments will have multiple Client IDs. END DATE: The maturity or expiration date of the investment. FUND: The type of investment subscribed. GUARANTEED CAPITAL: The percentage of capital guaranteed, where applicable. WORKING AMOUNT: The operating capital on which returns are calculated. This amount does not include any reinvested profits. RANGE: The indicative annual return range, reflecting the risk level of the selected investment. Q1, Q2, Q3, Q4: Percentage and monetary value of any profit generated in the respective quarter, if applicable. YEARLY TOTAL: Total annual profit expressed as both a percentage and an amount in EUR. For clients who do not reinvest profits quarterly, this figure is shown only for the current quarter. CAPITAL + INVESTMENT: The total amount in EUR consisting of invested capital plus any profits generated during the year. REINVESTED PROFITS ON QUARTERLY BASIS: Indicates whether quarterly profit reinvestment has been selected. PAC AMOUNT ON QUARTERLY BASIS: Indicates whether a quarterly Capital Accumulation Plan (PAC) is active and the selected contribution amount. Support and Clarifications The team at INCOME CAPITAL MANAGEMENT remains fully available for any clarification or additional information regarding the annual report, investment data, or portfolio configurations. Kind regards, INCOME CAPITAL MANAGEMENT s.r.o.

September 2025 Results: Resilience and Performance in a Volatile Market Environment

September 2025 Results: Resilience and Performance in a Volatile Market Environment “Wake me up when September ends…” sang Green Day. For many investors, September 2025 was indeed a month they would have preferred to skip. Global financial markets experienced exceptional turbulence, elevated uncertainty, and volatility at historically high levels. Gold continued its strong upward trajectory, while geopolitical and macroeconomic developments kept investor sentiment fragile throughout the month. Despite these challenging conditions, our strategies delivered solid positive performance, confirming that discipline, diversification, and a structured risk-based approach can transform uncertainty into opportunity. Market Context: A Month Defined by Volatility September unfolded against a backdrop of persistent geopolitical tension, macroeconomic realignment, and heightened sensitivity to policy signals. In such an environment, markets often reward resilience rather than speculation. Short-term reactions can amplify volatility, while structured strategies focused on risk control tend to demonstrate greater stability. Forex Fund Performance – Aggressive Level Even in this highly unstable context, the Forex Fund (Aggressive Level) closed the month with positive results: September 2025: +2.30% Year-to-date (January–September 2025): +28.16% Cumulative since inception (April 2024): +58.21% Since the beginning of August 2025, the strategy has been managed with a more cautious and prudent approach, reflecting the exceptionally high volatility observed across markets. This adjustment highlights the importance of flexibility within a disciplined framework, allowing portfolios to adapt while maintaining clear risk controls. Real Estate Fund Performance The Real Estate Fund also continued to deliver steady growth during September: September 2025: +0.45% Year-to-date (January–September 2025): +6.44% Cumulative since inception (April 2024): +12.64% While summer months typically represent a slowdown for the real estate sector, activity traditionally resumes with the arrival of autumn. Growth continues to be supported by sustained demand for tangible assets, particularly from investors seeking stability amid broader market uncertainty. Physical Gold Allocation Gold remained a central component of portfolio protection strategies throughout September. Purchased in September: 1.6 kg Total gold in custody: 11.6 kg Market value as of 30/09/2025: €1,228,440 (€105.90 per gram) The increase in demand is consistent with investors’ continued search for protection, reinforced by the strengthening of the spot gold price. In periods of elevated uncertainty, physical gold continues to fulfill its role as a strategic store of value. Transparency and Reporting Detailed performance reports are available at the following link: Access detailed reports → Active clients can find comprehensive data for all managed financial instruments in the private area, under the RESULTS section. Final Considerations September 2025 reinforces a key lesson: in times of heightened uncertainty, resilient strategies grounded in diversification and risk discipline make the difference. While markets remain unpredictable, structured investment approaches continue to demonstrate their ability not only to withstand volatility, but to convert it into sustainable performance. Original LinkedIn post: Read the original update on LinkedIn INCOME CAPITAL MANAGEMENT

July 2025: Extreme Volatility and Forex Fund Performance Under Unprecedented Market Stress

July 2025: Extreme Volatility and Forex Fund Performance Under Unprecedented Market Stress July 2025 proved to be one of the most challenging months in recent financial market history, particularly during its final two weeks. A period that is typically characterized by low volatility and reduced trading activity instead delivered extreme and unpredictable market movements, driven by a combination of political tension, speculative positioning, and fragile liquidity conditions. An Unusual Market Environment The month was dominated by escalating tensions over trade tariffs between Europe and the United States. These developments triggered a rapid sequence of events that destabilized the currency markets, particularly the EUR/USD pair. Initially, the European Central Bank intervened to artificially support the Euro, aiming to strengthen the European Commission’s position during ongoing negotiations. This was followed by a swift resurgence of the US Dollar as the dominant global currency. Crucially, these movements occurred against a backdrop of very low trading volumes, amplifying price swings and resulting in levels of volatility that, in certain moments, were unprecedented—even compared to the 2008 financial crisis. EUR/USD: Exceptional Price Swings The EUR/USD exchange rate illustrated the severity of market dislocation: Such rapid reversals within a compressed timeframe underscore the fragility of market sentiment and the risks associated with speculative flows during low-liquidity periods. Geopolitical Escalation and Risk Perception Market instability was further compounded by emerging geopolitical tensions, including the deployment of US submarines. While the prospect of nuclear escalation remains theoretical, even the suggestion of such risk materially affects investor behavior, volatility expectations, and capital allocation decisions. In environments like this, risk perception often outweighs fundamentals, creating conditions where price movements become disconnected from traditional valuation frameworks. Forex Fund Performance Overview Against this exceptionally turbulent backdrop, the Forex Fund (Aggressive Strategy) recorded the following results: While July closed negatively, the broader performance context remains solid, reflecting the strength of the strategy over longer horizons. Capital Protection as a Priority In periods of extreme and irregular volatility, prudence becomes essential. Our primary objective remains capital protection, with profit generation as a secondary goal. While speculative market movements are inherently unpredictable and beyond direct control, our focus is on maintaining vigilance and preserving the ability to act decisively when conditions normalize. This disciplined approach allows us to manage drawdowns while keeping portfolios positioned for recovery when market dynamics become more rational. Transparency and Reporting A detailed monthly return overview is available in the private area: View the full July 2025 performance report → We believe transparent reporting is essential, especially during challenging phases, enabling investors to evaluate performance within its proper market context. Final Considerations July 2025 serves as a reminder that extreme volatility can emerge even during periods traditionally considered stable. In such environments, discipline, risk management, and a long-term perspective remain the most effective tools for navigating uncertainty. INCOME CAPITAL MANAGEMENT

Risk Management and Consistency: The Foundations of Sustainable Investment Results

Risk Management and Consistency: The Foundations of Sustainable Investment Results Investment performance is often judged by returns alone. However, over full market cycles, it is risk management—not return maximization—that ultimately determines the sustainability of results. In an environment characterized by frequent volatility, rapid sentiment shifts, and geopolitical uncertainty, the ability to control downside exposure becomes a decisive competitive advantage. Why Risk Management Comes First Every investment strategy operates within uncertainty. The difference between durable performance and capital erosion lies in how risk is identified, measured, and managed. Effective risk management is not reactive. It is embedded into portfolio construction and execution through: Defined exposure limits aligned with volatility Diversification across instruments and risk drivers Continuous monitoring and adjustment of positions This framework allows portfolios to remain operational even when market conditions deteriorate. Consistency Across Market Cycles Short-term results can be influenced by favorable market phases. Consistency, however, is achieved only through disciplined execution across multiple cycles. Strategies that prioritize repeatability over opportunistic risk-taking are better positioned to deliver stable outcomes over time. Capital Preservation as a Strategic Objective Preserving capital during adverse phases is not a defensive stance—it is a strategic choice that enables long-term participation. By limiting drawdowns and avoiding forced decisions, portfolios maintain the flexibility required to reallocate capital when opportunities emerge. Risk Management and Investor Alignment Transparent risk frameworks also strengthen alignment between investors and portfolio managers. When risk parameters are clearly defined and consistently applied, investors can evaluate performance with a full understanding of the trade-offs involved. Final Considerations In uncertain markets, consistency is rarely accidental. It is the outcome of structured processes, disciplined risk controls, and a long-term perspective that prioritizes durability over short-term excitement. Original LinkedIn post: Read the original discussion on LinkedIn INCOME CAPITAL MANAGEMENT

Managing Volatility in Forex Markets: A Disciplined Investment Framework

Managing Volatility in Forex Markets: A Disciplined Investment Framework Volatility has become a structural feature of global financial markets. In 2025, currency markets in particular have reflected a complex mix of monetary policy divergence, geopolitical tension, and shifting capital flows. For investors, this environment reinforces a simple truth: performance is not driven by prediction, but by process. At INCOME CAPITAL MANAGEMENT, our approach to Forex investing is built around this principle. Rather than reacting to short-term noise, we focus on structured execution, controlled exposure, and continuous risk assessment. The Forex Market in 2025: Complexity, Not Chaos Foreign exchange markets are often perceived as purely speculative. In reality, they are among the most liquid and information-rich markets globally. However, in periods of heightened uncertainty, liquidity alone is not enough. Throughout 2025, FX markets have been influenced by: Diverging interest rate expectations across major economies Persistent geopolitical risk affecting capital allocation Increased correlation between currencies and broader risk assets This backdrop rewards strategies that are adaptive, disciplined, and grounded in measurable risk parameters. A Structured Approach to Forex Exposure Our Forex strategy does not rely on directional bets or discretionary timing. Instead, it is designed to operate through a defined framework that emphasizes: Risk-adjusted positioning, with predefined exposure limits Active management based on evolving market conditions Capital preservation as a core objective, not a secondary consideration Consistency of execution, reducing emotional decision-making This structure allows the strategy to remain operational even when market conditions become less predictable. Why Discipline Matters More Than Direction In volatile markets, attempting to forecast every move often leads to overexposure and inconsistent outcomes. A disciplined framework, by contrast, focuses on managing what can be controlled: risk, position sizing, and execution quality. Our experience confirms that sustainable performance in Forex investing is achieved not by maximizing exposure, but by maintaining flexibility while respecting defined risk constraints. Transparency and Investor Alignment Transparency remains a central pillar of our investment philosophy. Clear reporting, measurable performance, and a well-defined strategy allow investors to understand not only what results are achieved, but how they are generated. In an environment where volatility is likely to persist, clarity and structure become competitive advantages. LinkedIn Source This article is based on the original update published on LinkedIn: View the original LinkedIn post → Looking Forward As global markets continue to evolve, our focus remains unchanged: disciplined execution, robust risk management, and consistent alignment with investor objectives. In Forex markets especially, the ability to navigate volatility with structure—not speculation—will continue to define long-term success. INCOME CAPITAL MANAGEMENT

From ESG to AI: Hype Cycle or Structural Shift in Investing?

From ESG to AI: Hype Cycle or Structural Shift in Investing? Financial markets have always been fertile ground for narratives. Over the years, entire investment frameworks have risen, peaked, and faded—often driven as much by storytelling as by substance. Few examples illustrate this better than the recent trajectory of ESG investing. A few years ago, ESG was everywhere. Asset managers, funds, and advisory firms rushed to demonstrate alignment with environmental, social, and governance principles. New products were launched, reporting frameworks multiplied, and ESG quickly became a commercial and marketing standard. Then, almost as quickly, the momentum faded. The Rise and Cooling of ESG Today, much of the ESG hype has dissipated. Many ESG-labelled products have been rebranded, consolidated, or quietly discontinued. Investors have shifted their focus, becoming more selective and increasingly sceptical of surface-level claims that lack measurable impact. This evolution does not mean sustainability has lost relevance. Rather, it highlights a familiar pattern in finance: when a concept becomes primarily a narrative tool instead of an operational discipline, disillusionment follows. AI Takes Centre Stage Now, a new theme dominates the conversation: Artificial Intelligence. From asset managers to analysts and technology providers, AI is being embraced across the investment industry. The enthusiasm is unmistakable. Yet this raises a critical question: is AI simply the next ESG—another hype cycle destined to fade? Where AI Is Already Changing the Game Unlike ESG narratives, AI is already delivering tangible applications—particularly in trading and, even more so, in the foreign exchange market. Machine learning models are increasingly used to: Optimize signal detection across complex market environments Adapt execution strategies dynamically Manage risk exposure in real time Process vast volumes of macroeconomic data, news flow, and central bank communications Some investment strategies now rely on AI-driven systems to interpret market sentiment and anticipate currency movements with a speed and depth that traditional models cannot replicate. Why AI Is Not a Shortcut That said, AI is not magic. Its effectiveness depends on data quality, model governance, and disciplined human oversight. Without these elements, AI risks becoming little more than a sophisticated buzzword—much like ESG did at its peak. Technology alone does not eliminate risk. It reshapes how risk is identified, measured, and managed. The Key Difference Between ESG and AI The crucial distinction lies in utility. While ESG often struggled to move beyond narrative alignment, AI offers concrete tools that directly influence decision-making processes. It enhances speed, consistency, and analytical depth—but only when embedded within a robust investment framework. Still, it is too early to declare AI a definitive structural shift. Finance has a long history of turning innovation into storytelling cycles: enthusiasm, saturation, disillusionment, and eventual correction. A Measured Perspective AI may indeed reshape how investments are managed—but only if applied with discipline, transparency, and accountability. Otherwise, it risks following the same arc as previous trends. In investing, technology should serve process—not replace judgment. Understanding this distinction is what separates durable innovation from temporary hype. This article is based on a recent market commentary originally published on LinkedIn. 👉 Read the original LinkedIn post here Paolo Volpicelli INCOME CAPITAL MANAGEMENT s.r.o.

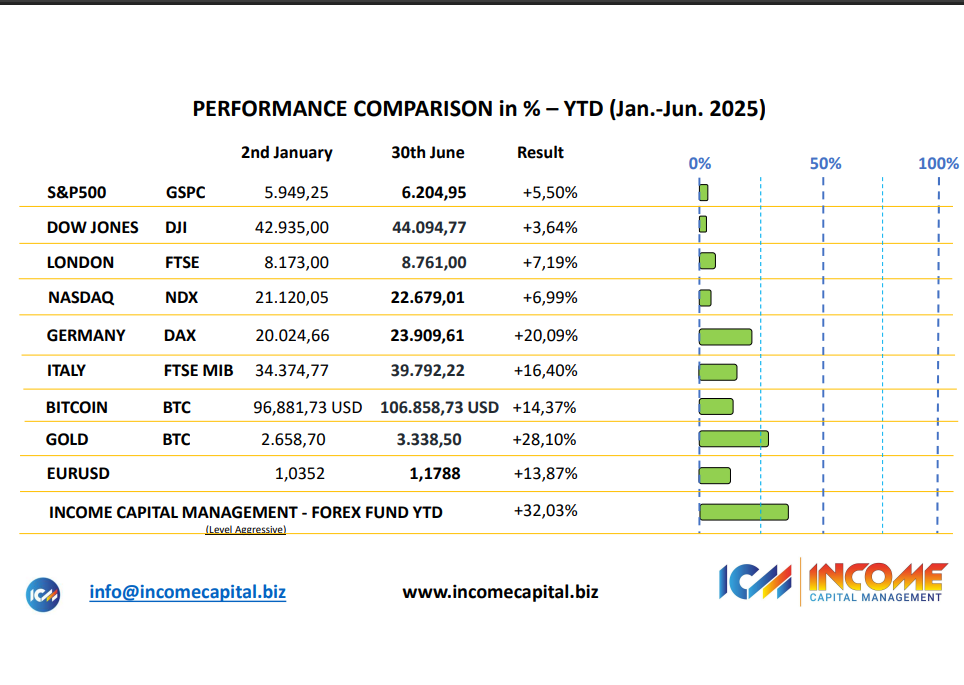

INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction

INCOME CAPITAL MANAGEMENT Shines in H1 2025: Performance, Discipline, and Conviction The first half of 2025 has been anything but simple for global financial markets. Persistent geopolitical tensions, fluctuating monetary policies, and ongoing macroeconomic uncertainty have created an environment where consistency and discipline matter more than bold predictions. Against this backdrop, INCOME CAPITAL MANAGEMENT delivered a solid and measurable result, confirming the robustness of its investment framework and the effectiveness of its risk-controlled execution. 📊 Strong Performance in a Challenging Environment During the first half of 2025, our Aggressive Investment Level achieved: +32.03% cumulative return (H1 2025) +62.08% cumulative return since April 2024 These figures are not the result of isolated market events or short-term positioning. They reflect a structured and repeatable investment process built around: Disciplined FX strategy execution Dynamic exposure management Continuous risk monitoring and adjustment Data-driven decision-making Past performance refers to the Aggressive Investment Level and is not indicative of future results. 📌 Structure Over Speculation As highlighted by our Founder & CEO, Paolo Volpicelli, performance is not driven by luck: “Our edge is not luck — it is structure, conviction, and execution.” At INCOME CAPITAL MANAGEMENT, we do not attempt to predict markets. Instead, we focus on understanding them, adapting to changing conditions, and maintaining a disciplined framework that prioritizes capital preservation alongside growth. In an environment where many strategies struggle to remain consistent, our approach continues to demonstrate resilience through methodical positioning and controlled risk exposure. 🔍 Transparency and Measurable Results We believe that performance should always be: Measurable – backed by real data Transparent – clearly reported and accessible Consistent – aligned with a defined investment process Our results reflect not only market opportunities but also the strength of a framework designed to operate effectively during both expansionary and volatile phases. 🔗 Further Insights For the original update and additional context, you can view the LinkedIn article here: View the original LinkedIn post → 🧠 Looking Ahead The first half of 2025 reinforces a key principle: in complex markets, conviction and consistency outperform noise and reaction. As we move into the second half of the year, our focus remains unchanged — protecting capital, managing risk intelligently, and delivering sustainable performance through disciplined execution. INCOME CAPITAL MANAGEMENT continues to build results through structure, not shortcuts.